Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is underneath strain after failing to interrupt above the $1,874 excessive set on Could 1st, a degree that now acts as stiff resistance. Because the broader crypto market begins to warmth up, Ethereum stays caught in a decent vary, missing the momentum to substantiate a breakout. Presently buying and selling simply above $1,800, ETH sits at a important degree the place bulls should step in to defend the construction and push the value greater.

Associated Studying

Regardless of a number of makes an attempt, Ethereum has been unable to determine a transparent course, and market individuals are rising cautious. The asset continues to be down over 55% from its December highs, reflecting a chronic interval of weak point relative to different main cryptocurrencies. And not using a sturdy push by way of resistance, Ethereum dangers falling additional behind.

Prime crypto investor Michael Van de Poppe just lately shared a technical evaluation suggesting that Ethereum continues to be in an accumulation phase. In line with Van de Poppe, ETH reveals indicators of power and accumulation in opposition to BTC within the background, however wants affirmation by way of a decisive breakout above present ranges. Till then, Ethereum stays range-bound and susceptible to volatility. With market sentiment shifting and main strikes looming, the approaching days will probably be essential for ETH’s short-term outlook.

Ethereum Accumulation: ETH/BTC Chart Hints At Imminent Transfer

Ethereum continues to wrestle under the $2,000 mark, failing to reclaim key resistance ranges regardless of broader market exercise heating up. Whereas ETH/USD stays directionless and nonetheless trades over 55% under its December highs, a more in-depth have a look at the ETH/BTC chart reveals one thing extra constructive brewing beneath the floor.

Van de Poppe just lately shared an evaluation highlighting a transparent accumulation construction forming within the ETH/BTC pair. After months of constant draw back, the chart reveals Ethereum breaking out of a falling wedge and consolidating in a decent vary just under important resistance at 0.0195 BTC. In line with Van de Poppe, it is a basic accumulation sample, signaling that Ethereum could also be making ready for a major breakout relative to Bitcoin.

The chart additionally highlights a key demand zone round 0.0184 BTC—an space ETH has repeatedly held. So long as this degree holds, Van de Poppe believes Ethereum might proceed to grind greater and finally take out liquidity above resistance. A profitable breakout might mark the beginning of Ethereum outperforming Bitcoin, a pattern usually seen through the altcoin enlargement part of a bull market.

Nevertheless, dangers stay. The broader market continues to be closely influenced by macroeconomic uncertainty, significantly surrounding U.S.-China tensions. For now, Ethereum’s upside case relies on holding present assist and clearing the 0.0195 BTC resistance. If profitable, this accumulation could develop into the bottom for a powerful rally.

Associated Studying

ETH Worth Consolidates In A Tight Vary

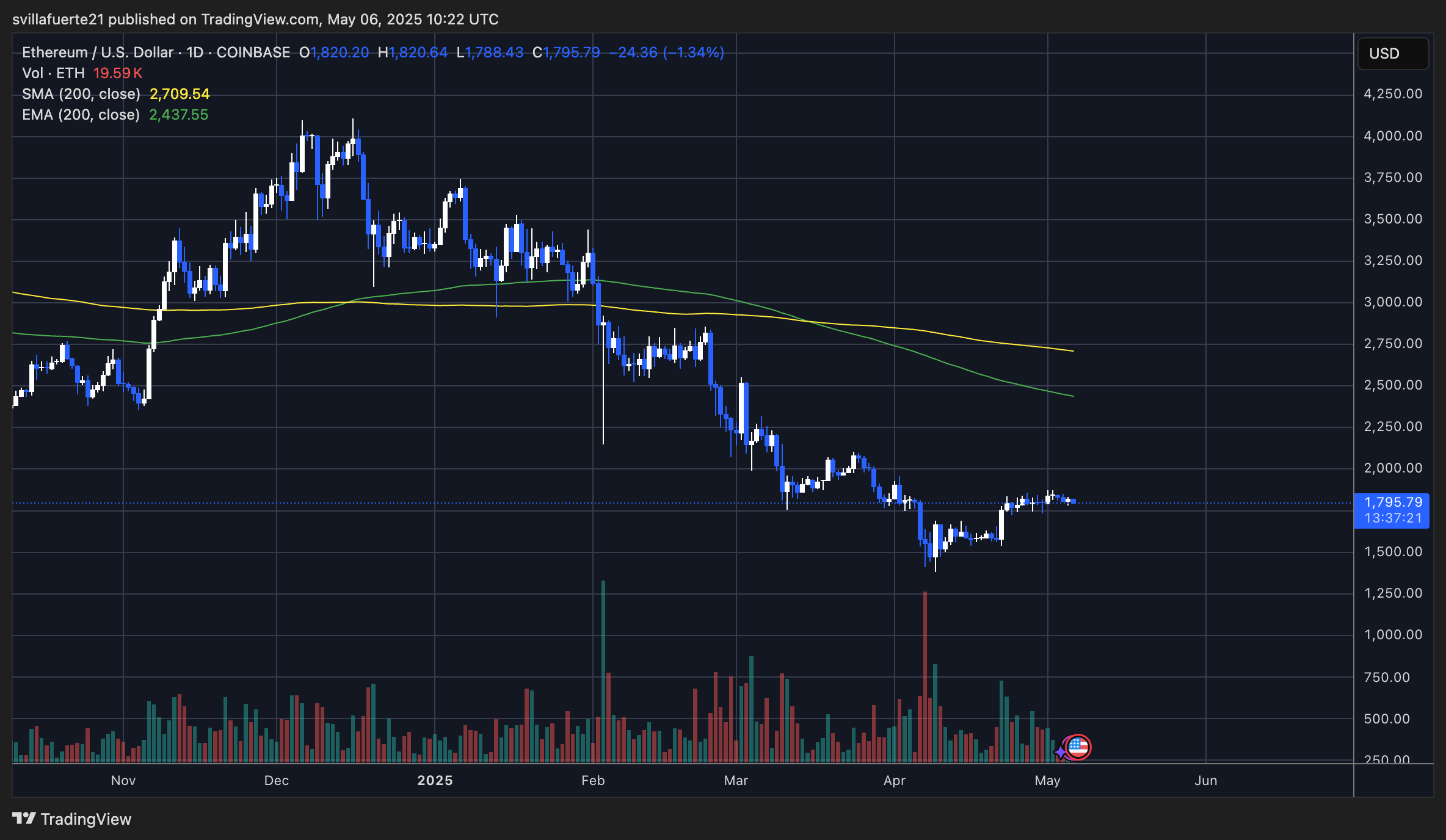

Ethereum is presently buying and selling at $1,795.79 after a slight rejection from the $1,874 native excessive reached on Could 1st. The day by day chart reveals ETH consolidating in a decent vary following its rebound from April’s lows close to $1,500. Nevertheless, regardless of this stabilization, ETH stays properly under each the 200-day easy transferring common (SMA) at $2,709.54 and the 200-day exponential transferring common (EMA) at $2,437.55—indicating that the broader pattern continues to be bearish.

Whereas bulls have managed to stop additional draw back, Ethereum has but to interrupt out of its long-term downtrend. The failure to reclaim $2,000 as assist continues to cap bullish momentum, and quantity has remained modest throughout latest worth motion, exhibiting an absence of conviction from each consumers and sellers.

The construction presently favors accumulation, however ETH should decisively clear the $1,875–$2,000 resistance space to shift sentiment and validate a pattern reversal. If it fails to take action, the danger of a renewed pullback towards the $1,650–$1,700 assist zone will increase.

Associated Studying

Total, Ethereum is at a pivotal stage. The longer it consolidates under main transferring averages, the extra doubtless the market stays cautious. A breakout above $2,000 might set off renewed upside and sign broader market power.

Featured picture from Dall-E, chart from TradingView