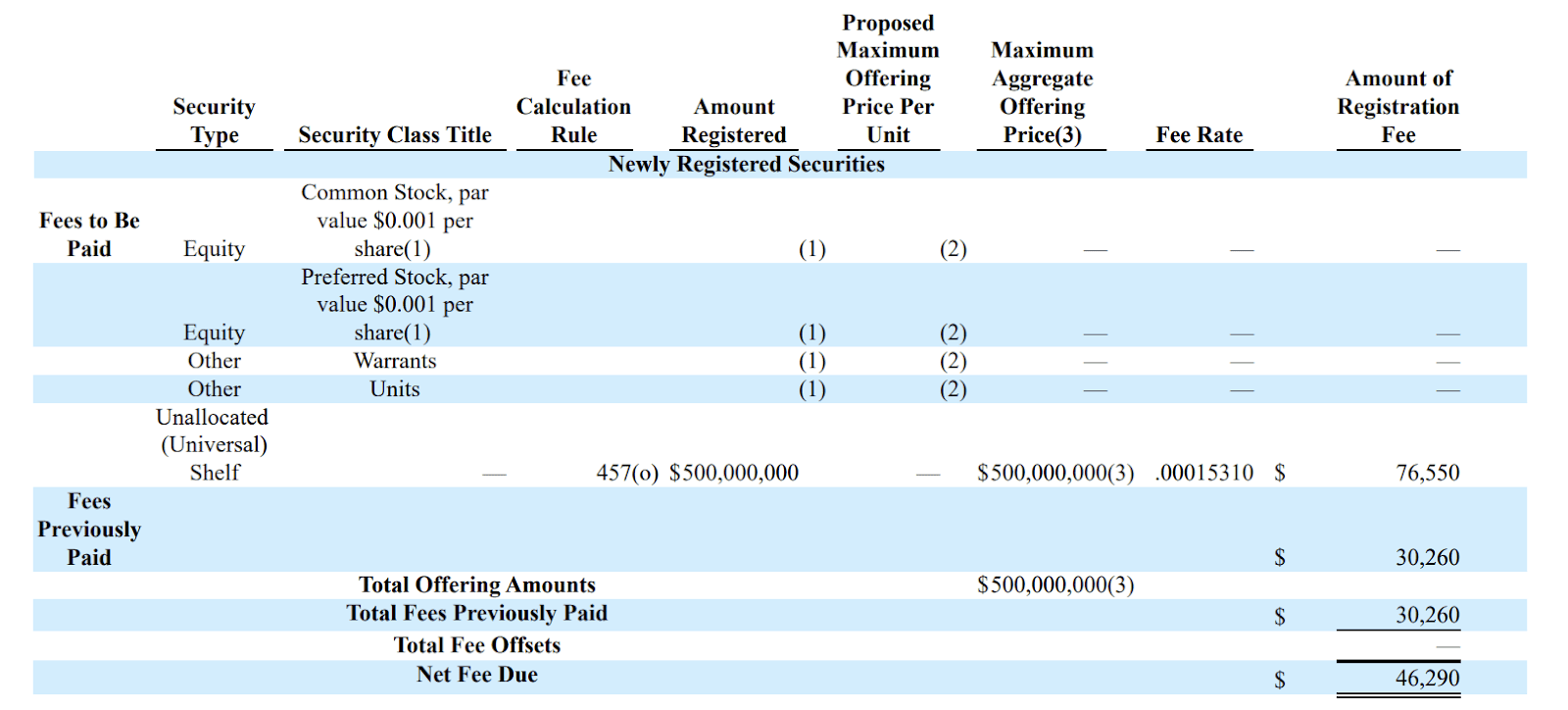

Thumzup Media Corporation (Nasdaq: TZUP) has filed an modification to its shelf registration on Form S-3 with the Securities and Change Fee, rising the utmost providing quantity from $200 million to $500 million. The transfer alerts a major ramp-up within the firm’s twin mission: scaling its social media branding platform and rising its Bitcoin holdings.

As of Could 5, 2025, Thumzup holds 19.106 BTC valued at roughly $1.8 million. The corporate’s board had beforehand greenlit a daring treasury technique permitting as much as 90% of its liquid property to be held in Bitcoin. This expanded registration provides Thumzup the pliability to boost capital by way of a number of avenues, together with frequent inventory, most popular inventory, warrants, debt securities, and items, over the subsequent three years.

In accordance with the corporate’s submitting, “We view bitcoin as a dependable retailer of worth and a compelling funding. We consider it has distinctive traits as a scarce and finite asset that may function an inexpensive inflation hedge and protected haven amid world instability”.

No securities are being offered right now. Nonetheless, any future providing below the registration will likely be detailed in a prospectus complement filed with the SEC.

The amended submitting reaffirms Thumzup’s conviction in Bitcoin’s long-term potential, drawing comparisons to gold. “Given our perception that bitcoin is a comparable and probably higher retailer of worth than gold… bitcoin has the potential to method or exceed the worth of gold over time,” the corporate said.

This growth follows a broader shift in Thumzup’s operational technique. Since its Nasdaq listing in October 2024, the corporate has adopted Bitcoin as its main treasury reserve asset and introduced plans to supply funds in Bitcoin by way of its Account Specialist Program. As Thumzup positions itself on the crossroads of digital advertising and marketing and digital forex, this expanded registration marks a robust sign of its future intentions. For buyers and analysts monitoring company Bitcoin adoption, Thumzup’s newest submitting is one other instance of a publicly traded firm doubling down on BTC as a core monetary technique.