Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin continued its climb previous $104,000 on Monday, and that rally has tempted some huge merchants to wager in opposition to it. Just a few high-stakes quick positions now sit on the point of collapse. These trades carry skinny margins for error and present simply how dangerous big margin bets may be when value momentum stays sturdy.

Associated Studying

Huge Brief Place At Danger

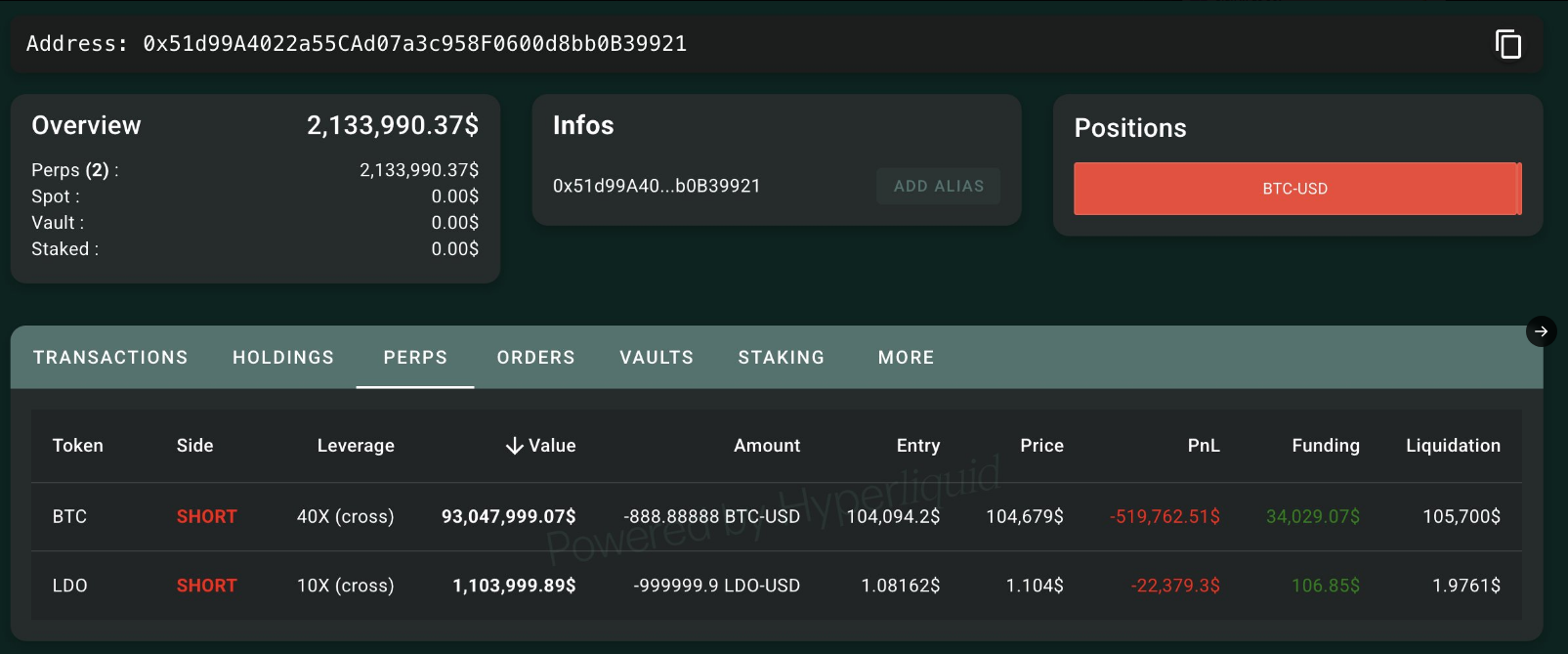

In line with blockchain tracker Lookonchain, one whale pockets opened a $93 million quick with 40× margin. At Bitcoin’s current level close to $104,000, only a 1.5% uptick would pressure a shutdown at round $105,700. Which means a small transfer might wipe it out. Proper now, that place is sitting on over $500,000 in paper losses. It’s additionally incomes about $34,000 in funding charges. However these earnings are tiny subsequent to the loss, in order that they barely ease the ache.

Many gamblers are shorting $BTC with excessive leverage!

0x51d9 opened a $93M quick place on $BTC with 40x leverage, with a liquidation value of $105,690.

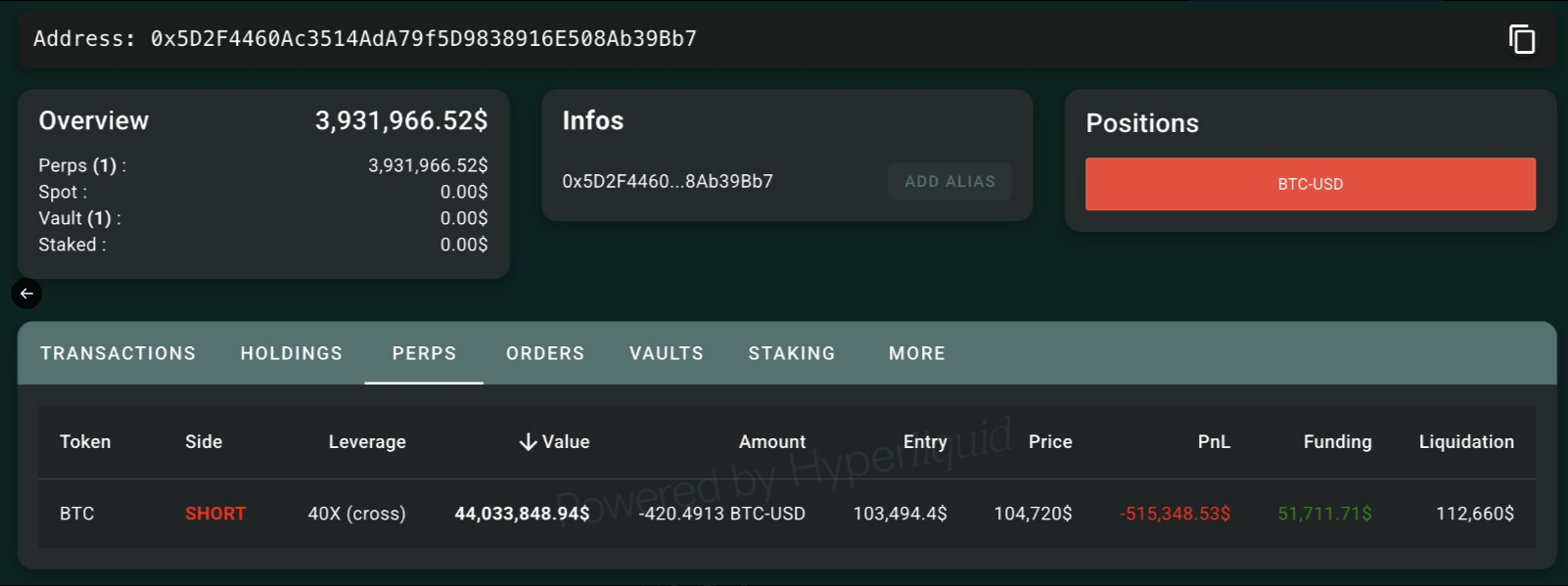

0x5D2F opened a $44M quick place on $BTC with 40x leverage, with a liquidation value of $112,660.https://t.co/WcW1u4FdWz… pic.twitter.com/pAf1LEMnZp

— Lookonchain (@lookonchain) May 12, 2025

Second Whale Holding At Crossroads

One other account took a $44 million quick at $103,494.40, once more utilizing 40× cross margin. Now that Bitcoin trades round $104,720, the commerce is down roughly $515,348.53. Its liquidation threshold is way additional out, at about $112,660. That offers a buffer of near $9,000 earlier than it’s worn out.

Thus far, this dealer has pocketed $51,711.71 in optimistic funding. These credit present that merchants are nonetheless betting on larger costs general. But if Bitcoin’s climb stays on monitor, that buffer might evaporate quick.

Failed Wager Already Closed

A 3rd whale obtained burned even sooner. This dealer offered quick $69.7 million price of Bitcoin at $95,969, utilizing 40× margin. Their cut-off value was $103,470. Bitcoin crossed that line days in the past, buying and selling above $104,000 in current classes. Based mostly on studies, that place has virtually actually been liquidated already. It serves as proof of simply how shortly high-risk shorts can backfire when costs shoot up.

Liquidations Spotlight Market Stress

Over the previous 12 hours, Bitcoin derivatives noticed $66.66 million in liquidations, with $51.25 million coming from shorts. Within the full 24-hour stretch, a complete of $82.58 million was worn out, and $60.97 million of that was on the quick facet. Longs solely accounted for $21 million in closures. These figures underline how a lot shopping for energy has been compelled again into the market, fueling additional positive factors.

Associated Studying

This frenzy exhibits that betting huge in opposition to Bitcoin’s rally can finish badly and quick. Small funding funds gained’t make up for large losses if value retains rising. Merchants taking big short positions now face steep odds of getting squeezed out. As Bitcoin sits above $104,000, any additional positive factors might push extra shorts to the exit, driving recent volatility within the days forward.

Featured picture from Pexels, chart from TradingView