Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) has surged over 40% up to now two weeks, buying and selling within the mid-$2,000 vary on the time of writing. Notably, a number of key indicators recommend that the continuing ETH rally is being pushed extra by spot market demand than leveraged buying and selling – an encouraging signal of a probably sustainable bull run.

Ethereum Rally Pushed By Spot Demand

After lagging behind different main cryptocurrencies like Bitcoin (BTC), Solana (SOL), and XRP for a lot of the previous 12 months, ETH is now displaying indicators of an natural uptrend. In accordance with CryptoQuant analyst ShayanMarkets, the present momentum seems to be primarily spot-driven, fairly than fueled by speculative futures buying and selling.

Associated Studying

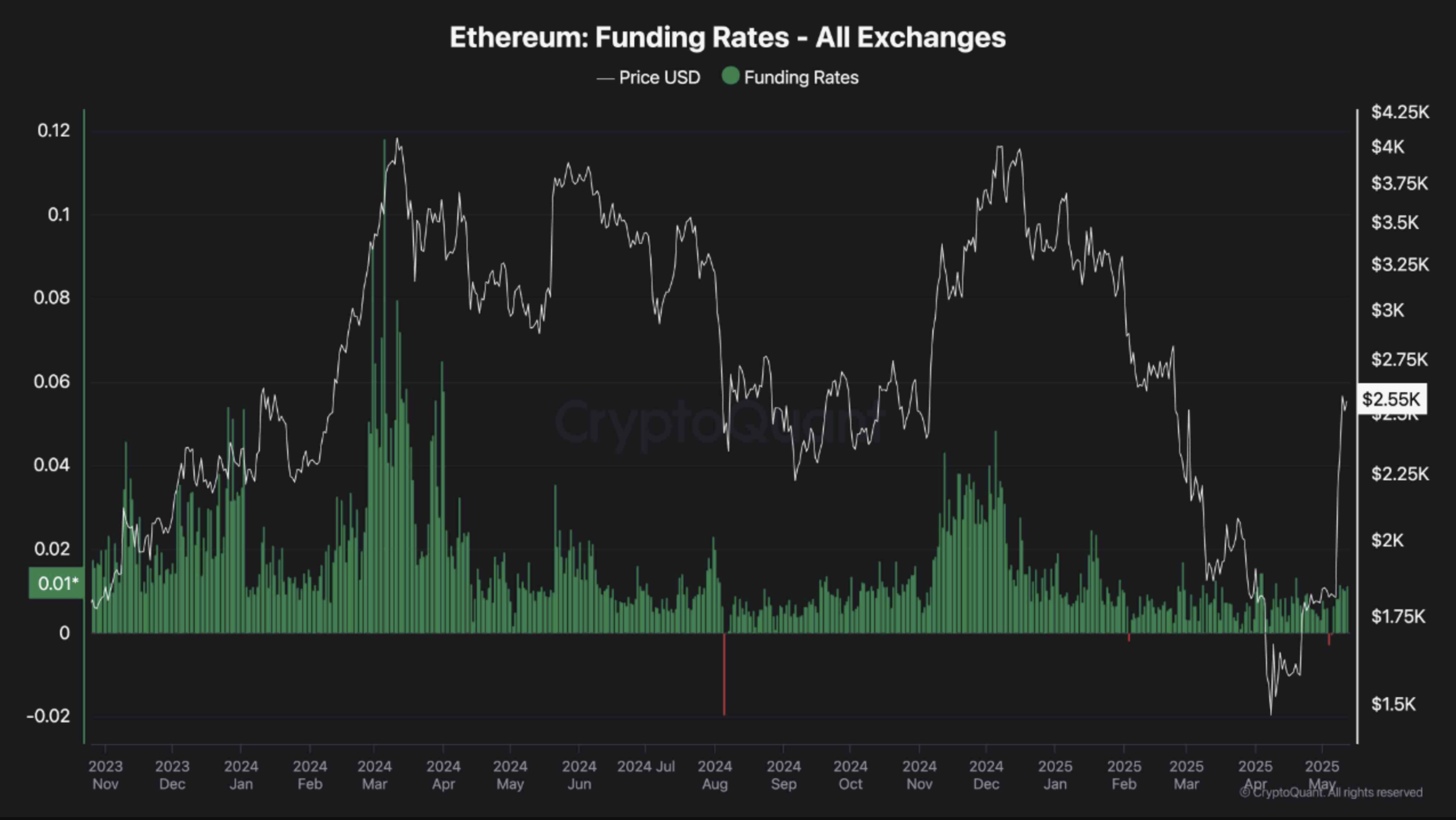

In a current CryptoQuant Quicktake publish, ShayanMarkets highlighted that ETH funding charges have remained ‘comparatively flat’ regardless of the worth surge. That is important as a result of funding charges are usually a mirrored image of sentiment within the perpetual futures market.

To elucidate, funding charges are periodic funds exchanged between merchants in perpetual futures contracts to maintain the contract value aligned with the spot value of the asset. Constructive funding charges point out that lengthy positions are paying shorts, usually signaling bullish market sentiment, whereas destructive charges recommend bearish sentiment.

In Ethereum’s case, flat funding charges throughout this current rally point out that the upward value motion is being powered by real shopping for within the spot market, not speculative leverage. This makes the uptrend much less vulnerable to sudden reversals triggered by mass liquidations. As ShayanMarkets famous:

Nonetheless, for the bullish momentum to be sustained and validated, funding charges ought to start to rise, reflecting elevated confidence and extra aggressive positioning by futures merchants.

In the meantime, different analysts predict additional upside for ETH. For example, famous crypto analyst Ali Martinez not too long ago remarked that if ETH can decisively break via the $2,380 resistance degree, then it may enter a brand new bull rally.

In his newest X publish, Martinez emphasised that ETH’s new essential help vary lies between $2,060 and $2,420. The analyst famous that near 10 million wallets maintain greater than 69 million ETH between these ranges.

New ETH ATH On The Horizon?

Though Ethereum stays properly under its all-time excessive (ATH) of $4,878 reached in November 2021, many market watchers imagine a brand new ATH for the second-largest cryptocurrency by market cap might be on the horizon.

Associated Studying

In the identical vein, crypto analyst Titan of Crypto not too long ago famous that ETH is following a V-shape restoration. The analyst shared the next weekly chart that compares BTC and ETH value motion, predicting that ETH is more likely to follow BTC’s trajectory.

In the meantime, analyst Ted Pillows outlined 5 bullish elements that might push ETH to $12,000 in 2025 – together with favorable regulatory developments and powerful inflows into spot exchange-traded funds (ETF). At press time, ETH trades at $2,555, up 3% up to now 24 hours.

Featured picture created with Unsplash, charts from CryptoQuant, X, and TradingView.com