In Q1 FY2025, Metaplanet posted the strongest monetary ends in its 20-year company historical past—pushed by a Bitcoin treasury technique that’s now working at scale.

Metaplanet isn’t simply aligning with Bitcoin. It’s compounding shareholder worth by way of it—by utilizing capital markets infrastructure, BTC-native KPIs, and recurring revenue methods to systematically enhance Bitcoin per share.

With 6,976 BTC on its steadiness sheet, a 170% BTC Yield year-to-date, and a rising world footprint, Metaplanet is not a sign — It’s a system.

A Breakout Quarter for Japan’s Bitcoin Treasury Chief

Metaplanet’s Q1 FY2025 outcomes marked a turning level—not solely by way of scale, however in consistency. For the primary time, each core working metrics and Bitcoin treasury KPIs broke firm information.

Quarterly Financials:

- Income: ¥877M (+8% QoQ)

- Working Revenue: ¥593M (+11% QoQ)

- Complete Belongings: ¥55.0B (+81%)

- Web Belongings: ¥50.4B (+197%)

- Unrealized BTC Positive factors (as of Might 12): ¥13.5B

Whereas the corporate reported a ¥7.4B valuation loss on its Bitcoin place as of the March quarter-end attributable to market costs, it famous that these losses had absolutely reversed—after which some—by mid-Might.

This context issues: valuation volatility is predicted in a BTC-denominated capital model. What issues extra is BTC per share progress, operational profitability, and capital effectivity—all of which trended strongly upward.

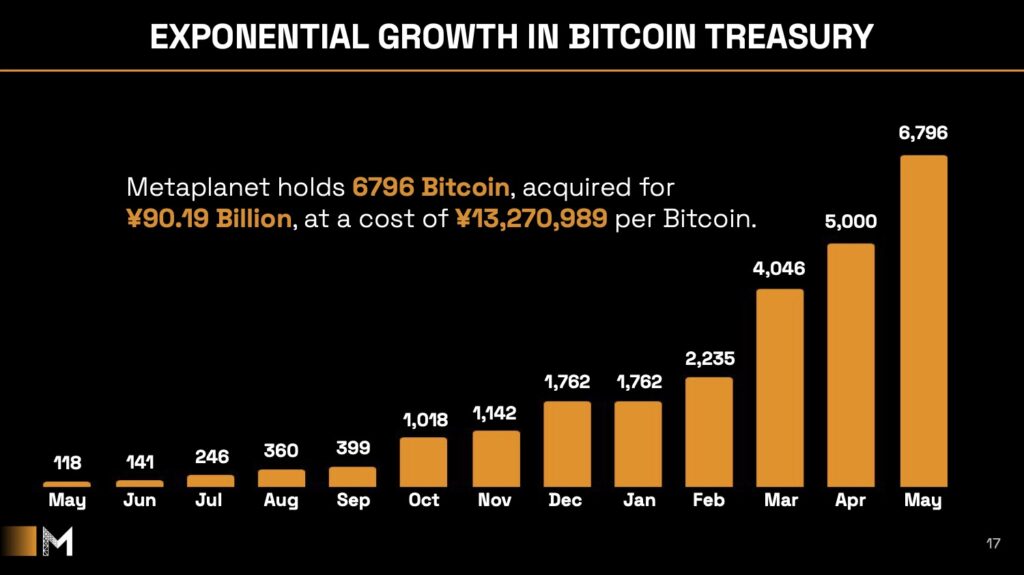

BTC Holdings Surge to six,976—Up 3.9x 12 months-to-Date

Metaplanet added 5,034 BTC in Q1 alone, rising its Bitcoin holdings to 6,976 BTC—a 3.9x enhance since January 1.

It now holds:

- ~68% of its near-term 10,000 BTC goal

- A value foundation of ¥13.27M per BTC

- A high 11 place globally and #1 in Asia amongst public firms by Bitcoin held

This accumulation was funded by way of Japan’s largest moving-strike warrant program, which permits the corporate to challenge fairness into market energy with out setting a set low cost or strike. As of Might 10:

- 87% of the 210M-share program has been executed

- ¥76.6B has been raised

- This system enabled steady BTC purchases with out disrupting share worth stability

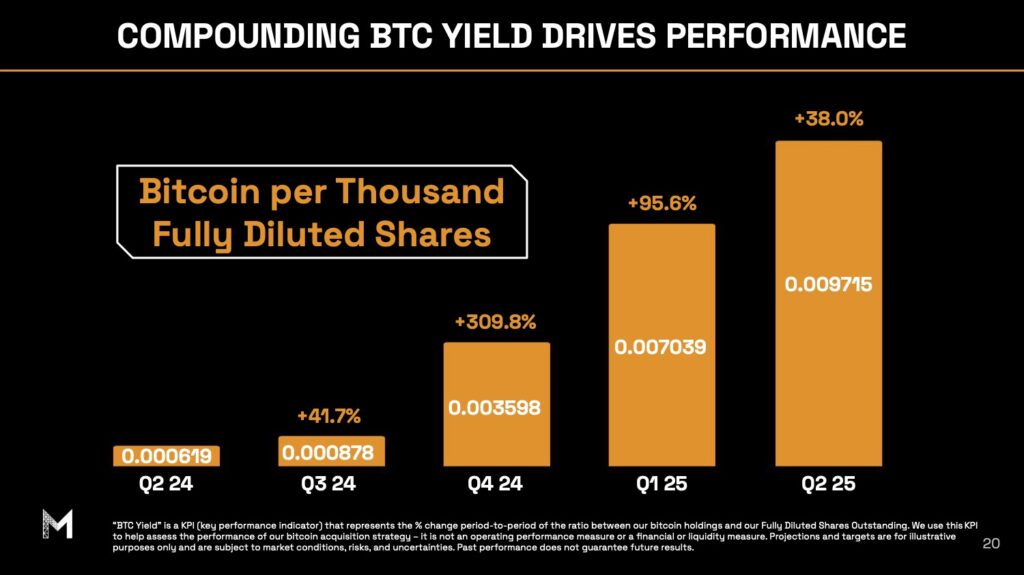

BTC Yield Hits 170%—A Defining KPI

Metaplanet tracks a novel Bitcoin-native KPI: BTC Yield, which measures the expansion in Bitcoin per diluted share. In Q1:

- BTC Yield: 170.0%

- BTC Achieve: 2,996 BTC

- BTC ¥ Achieve: ¥45.4B

This metric is central to how Metaplanet evaluates treasury efficiency—not in fiat returns, however in how successfully it grows BTC per shareholder unit.

BTC Yield displays not simply accumulation, however capital technique. Fairness raised should lead to BTC that outpaces dilution. If that occurs, BTC Yield goes up. If not, it drops. It’s a precision device for treasury self-discipline.

This mirrors the improvements pioneered by Technique (previously MicroStrategy), however with a distinctly Asia-Pacific capital markets mannequin.

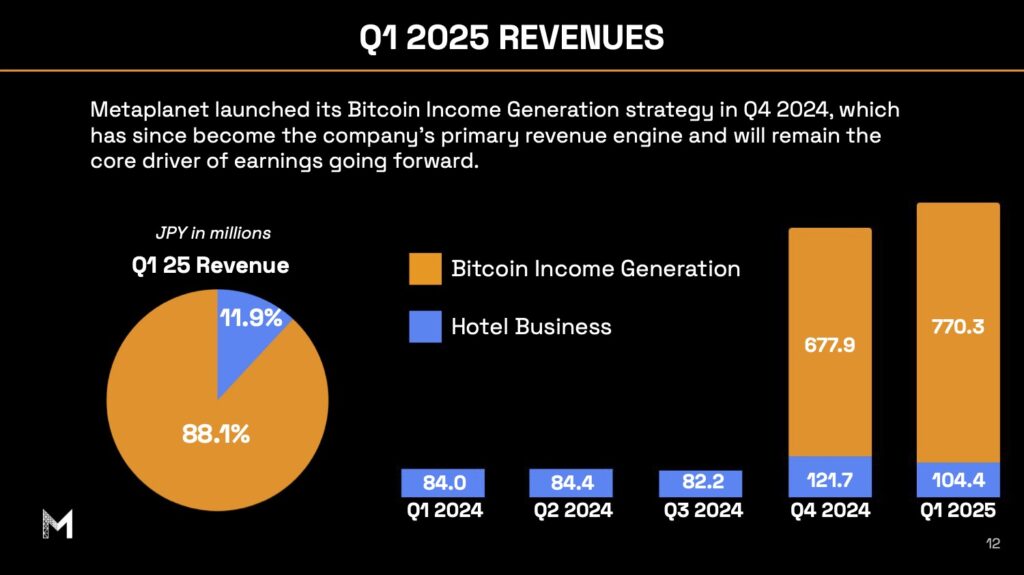

Working Revenue Hits New File—Pushed by Bitcoin Earnings

In contrast to many Bitcoin-focused companies, Metaplanet isn’t simply elevating capital and shopping for Bitcoin—it’s additionally producing recurring revenue.

Q1 working revenue was ¥592M, a brand new firm report.

Breakdown:

- ¥770M from Bitcoin Earnings Era (primarily from writing BTC cash-secured places)

- ¥104M from its legacy resort enterprise

- Working margin: 67.6%

Why it issues: this revenue mannequin reduces dependence on fairness issuance and improves capital flexibility. It additionally means new capital can go straight into BTC—to not fund operations. This reinforces Metaplanet’s skill to develop each BTC and BTC per share.

The corporate has now monetized 30 out of 58 days in 2025 by way of its BTC volatility methods, whereas sustaining strict draw back safety. This turns steadiness sheet volatility right into a income supply.

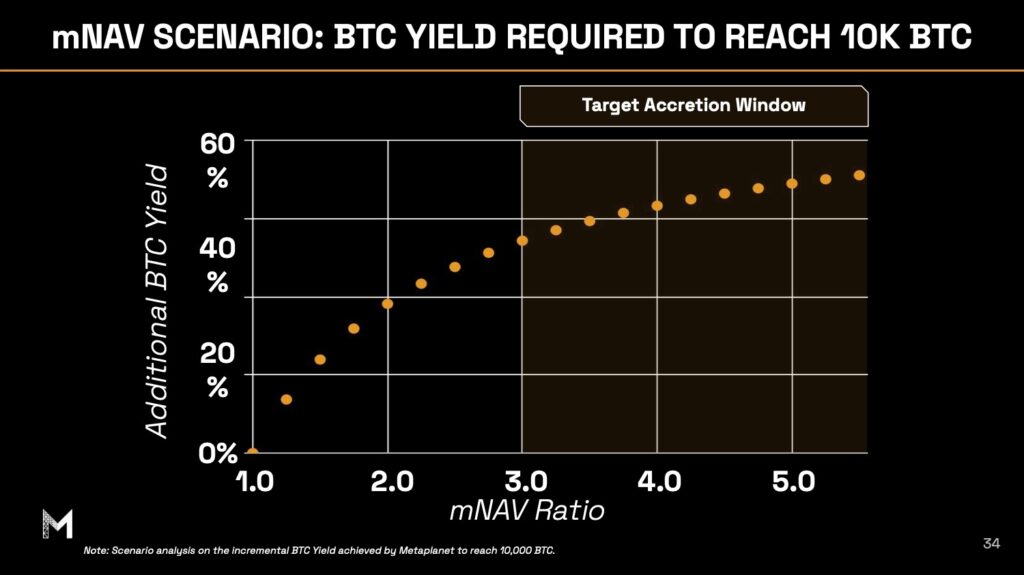

Metaplanet’s Premium to NAV and International Liquidity Edge

One of many defining options of Metaplanet’s public market presence is its skill to keep up a premium to NAV—a uncommon feat amongst Bitcoin treasury firms.

At present ranges, its fairness trades nicely above the mark-to-market worth of its BTC holdings, adjusted for dilution. This premium isn’t a speculative fluke—it’s a mirrored image of how the corporate is structurally positioned to outperform Bitcoin per share, and the way world traders are starting to grasp and worth in that functionality.

Drivers of this premium embody:

- Constant BTC Yield progress that reinforces long-term per-share worth

- A clear cap desk with no most well-liked fairness and no debt

- Deep home liquidity on the Tokyo Inventory Trade, the place Metaplanet has develop into one of many high 3 most actively traded shares by quantity in 2025

- Broad ETF inclusion and algorithmic index participation, attributable to its excessive volatility, sector neutrality, and tradability

- International publicity by way of MTPLF (U.S. OTC itemizing) and DN3 (Germany), offering accessibility to retail and institutional capital throughout time zones

- Clear, BTC-native treasury reporting that aligns with fashionable investor expectations

Metaplanet has additionally attracted cross-border capital flows from Bitcoin-aligned traders looking for jurisdictional diversification and treasury progress, not simply uncooked BTC publicity. The agency’s constantly optimistic BTC Yield and working margin has helped reinforce this shareholder base, resulting in natural demand-driven fairness issuance at accretive costs.

A Scalable Bitcoin Treasury Mannequin for Asia

As a Premiere Member of Bitcoin For Corporations, Metaplanet is enjoying an important position in shaping the worldwide Bitcoin treasury motion—significantly inside the Asia-Pacific area.

Whereas most Bitcoin treasury firms so far have emerged from the U.S., Metaplanet’s mannequin proves that Bitcoin-native capital technique can scale inside completely different regulatory frameworks, capital markets, and investor cultures.

The corporate’s design is purpose-built to maximise Bitcoin per share with out counting on mounted debt devices or opportunistic “buy-the-dip” moments. As an alternative, it leverages:

- Transferring-strike fairness applications that permit it to challenge shares solely when market demand helps it

- A programmable treasury acquisition framework, enabling day by day BTC purchases with out timing discretion or guide buying and selling

- BTC Earnings Era methods that flip volatility into working revenue

- Built-in liquidity infrastructure spanning three areas and currencies (JPY, USD, EUR)

As a Premiere Member of BFC, Metaplanet actively shares learnings, metrics, and execution insights with different public firms exploring Bitcoin treasury adoption. Its construction just isn’t solely repeatable—it’s exportable.

For corporates in Japan, Korea, Taiwan, Hong Kong, and Southeast Asia, Metaplanet gives greater than proof of idea. It gives a blueprint.

And as BFC continues to develop its worldwide footprint, Metaplanet’s position might be central to how the playbook for Bitcoin-native capital design evolves throughout world markets.

Conclusion: Metaplanet Strikes From Sign to System

Metaplanet is not simply Japan’s first public Bitcoin treasury firm. It’s turning into the primary in Asia to construct an operational mannequin that proves Bitcoin treasury technique can ship:

- Excessive working margins

- Capital-efficient BTC accumulation

- Scalable, clear shareholder efficiency metrics

- Public market outperformance

With 6,976 BTC on the steadiness sheet, 170% BTC Yield, and a premium valuation supported by execution—not hype—Metaplanet is setting a brand new customary.

It’s not simply holding Bitcoin. It’s displaying what a Bitcoin-first capital construction can actually do.