Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

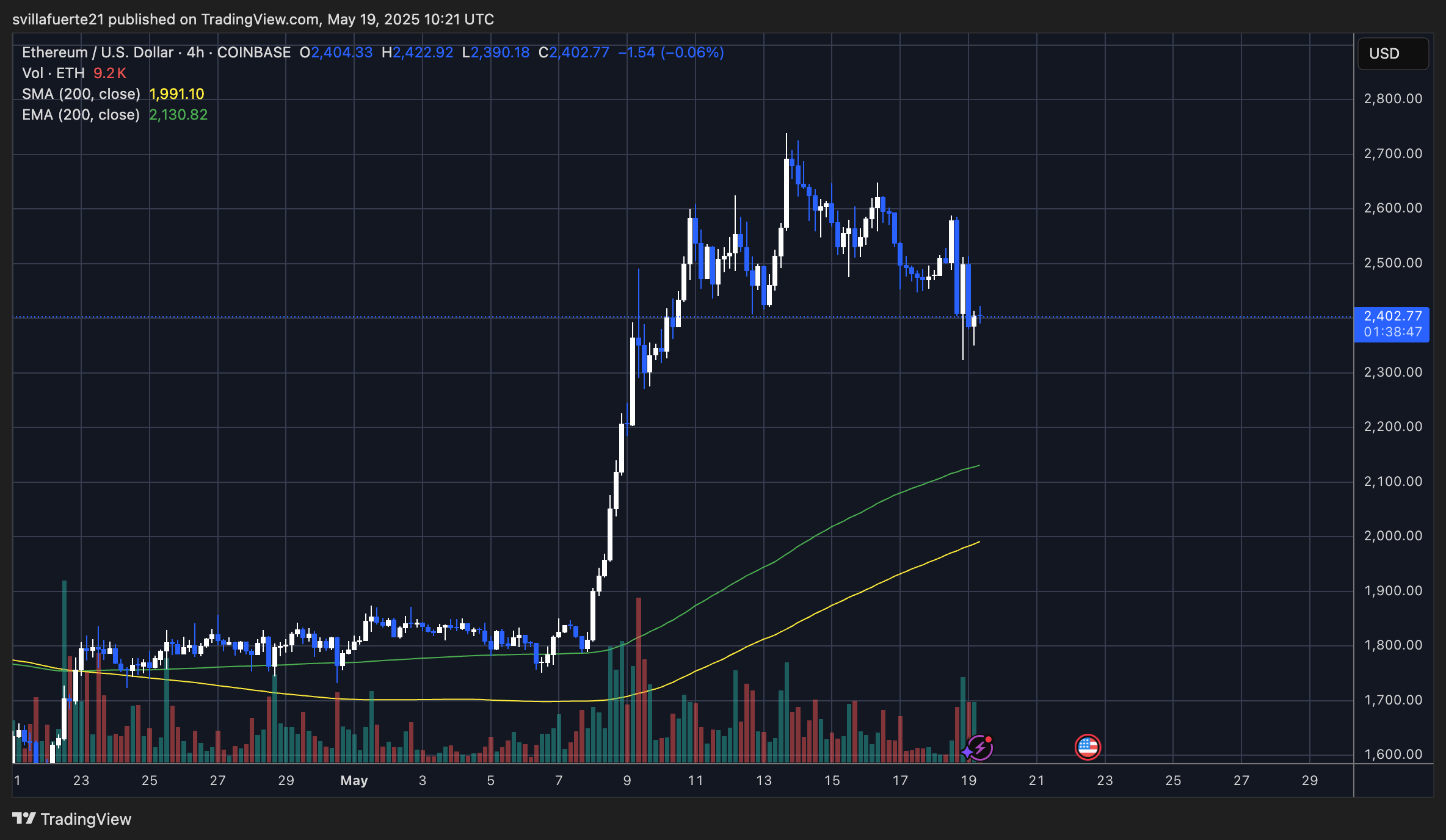

Ethereum is now buying and selling at a pivotal juncture after days of constant promoting stress which have pushed the worth down by greater than 12% since final Tuesday. At present hovering across the $2,400 mark, ETH is struggling to take care of bullish momentum, and lots of analysts warn {that a} deeper correction might observe if bulls fail to defend this significant help zone. The current drop displays broader market uncertainty, with rising volatility shaking investor confidence simply as ETH appeared prepared to hitch a wider altcoin breakout.

Associated Studying

Regardless of this weak spot, there’s rising optimism in some corners of the market. Prime analyst Ted Pillows shared a technical evaluation displaying {that a} Golden Cross has been confirmed on Ethereum’s 12-hour chart — a sign historically considered as a precursor to main bullish strikes. This crossover, which happens when the 50-period shifting common crosses above the 200-period shifting common, typically marks the start of an prolonged uptrend.

If bulls handle to carry present ranges and reclaim larger resistance close to $2,600, the Golden Cross might develop into a turning level. Till then, the approaching days might be crucial in figuring out whether or not Ethereum can bounce or sink into an extended consolidation section.

Volatility Hits Ethereum Amid Golden Cross Sign

Ethereum noticed sharp volatility over the weekend, surging previous $2,550 earlier than quickly reversing and falling again into the $2,400 zone inside hours. This sudden transfer has sparked renewed uncertainty, as analysts develop cautious concerning the fading bullish momentum and rising promoting stress. Whereas ETH stays one of many stronger performers within the broader altcoin market, it’s nonetheless down 36% from its December excessive of round $4,100. This leaves bulls with a transparent problem: maintain present ranges and regain management by pushing costs above $2,800 to ignite a sustained rally.

The $2,400 degree is now performing as a crucial help zone. A break under it might set off a deeper retracement, possible dragging Ethereum right into a consolidation vary and even towards decrease help ranges. Nonetheless, technical alerts supply a glimmer of hope.

According to Pillows, Ethereum just lately confirmed a Golden Cross on the 12-hour chart — a bullish sample that happens when the 50-period shifting common crosses above the 200-period shifting common. Traditionally, such alerts have preceded sturdy upside strikes, and Pillow believes this one might pave the way in which for Ethereum to achieve $3,000 within the close to time period.

Nonetheless, for that to occur, consumers should step in decisively. Quantity has tapered off, and sentiment seems fragile after final week’s breakdown. If bulls can defend the $2,400 area and reclaim larger resistance rapidly, the Golden Cross may mark the start of Ethereum’s subsequent leg up. Till then, the market stays in a wait-and-see mode, watching whether or not the bullish sign can outweigh the rising stress from sellers.

Associated Studying

ETH Exams Key Assist After Drop From Native Highs

Ethereum is buying and selling at $2,402 after a pointy Sunday sell-off, the place the worth spiked to $2,670 earlier than retracing greater than 10% in lower than 24 hours. As seen within the 4-hour chart, ETH is now consolidating proper above the $2,390–$2,400 zone, a degree that’s proving crucial for bulls to carry. This space coincides with a previous consolidation zone and will act as a short-term help base.

The 200-period EMA on the 4H chart is at present at $2,130, and the 200 SMA is close to $1,991 — each are considerably under the present worth and supply long-term pattern help. Nonetheless, the amount profile exhibits a spike in sell-side exercise in the course of the pullback, suggesting that short-term merchants are locking in earnings. If worth breaks under $2,390, a deeper retrace towards the $2,200–$2,300 vary turns into possible.

Associated Studying

On the upside, ETH should reclaim $2,550 to reestablish momentum. Failure to take action might affirm a neighborhood high. The worth motion is clearly indecisive, and this range-bound construction might persist until bulls reassert energy with a decisive transfer above $2,600. Till then, the $2,400 degree stays a battleground between consumers and sellers amid elevated volatility.

Featured picture from Dall-E, chart from TradingView