Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Ethereum (ETH) continues to hover across the $2,500 mark, indicators of market exhaustion are starting to emerge. Analysts recommend the second-largest cryptocurrency by market cap may face a short-term pullback earlier than trying to interrupt by means of larger resistance ranges.

Ethereum Displaying Indicators Of Overheating

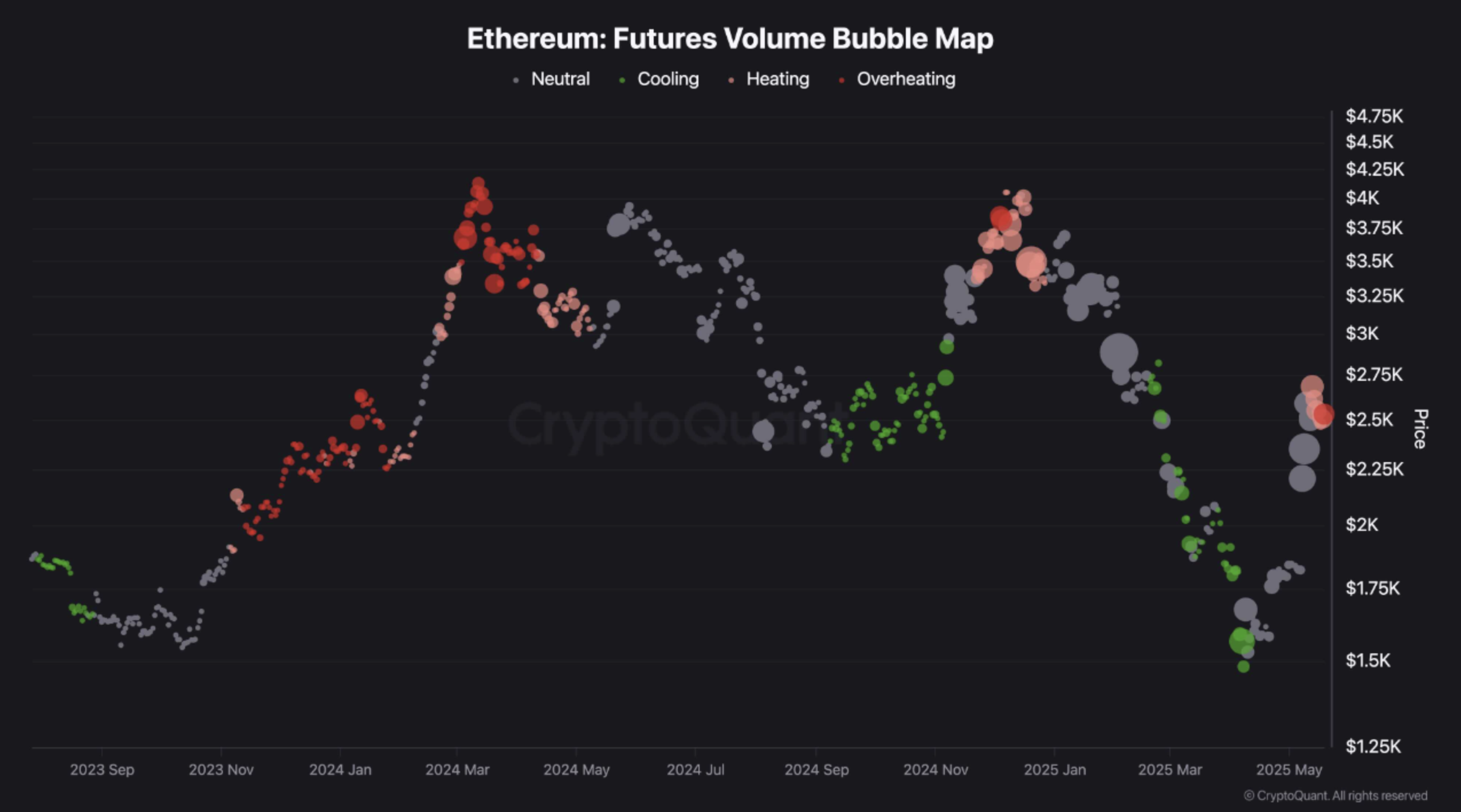

In accordance with a CryptoQuant Quicktake put up by contributor ShayanMarkets, ETH is starting to indicate indicators of an overheated rally. The analyst shared the next chart illustrating ETH’s complete buying and selling quantity throughout varied crypto exchanges.

On this chart, every bubble’s measurement displays the magnitude of buying and selling quantity, whereas the colour signifies the speed of quantity change, categorized into 4 teams – Cooling, Impartial, Overheating, and Extremely Overheating.

Associated Studying

Ethereum’s ongoing worth rally, which started in mid-April 2025, has seen a notable surge in buying and selling exercise. Inside only a month, the asset’s market situation shifted from Cooling (inexperienced bubbles) to Overheating (pink bubbles).

The present overheated situation might result in a short-term correction because the market cools and enters one other accumulation phase. Nonetheless, the depth and length of any potential pullback stay unsure.

The CryptoQuant contributor attributes this spike in quantity to profit-taking and vital resting provide on the psychologically vital $2,500 resistance degree. Information from CoinGecko exhibits ETH has jumped a powerful 59.7% over the previous 30 days, outperforming Bitcoin (BTC) throughout the identical interval. ShayanMarkets concludes:

Consequently, Ethereum is anticipated to proceed its consolidation section till contemporary demand emerges to drive a breakout above this resistance vary within the mid-term.

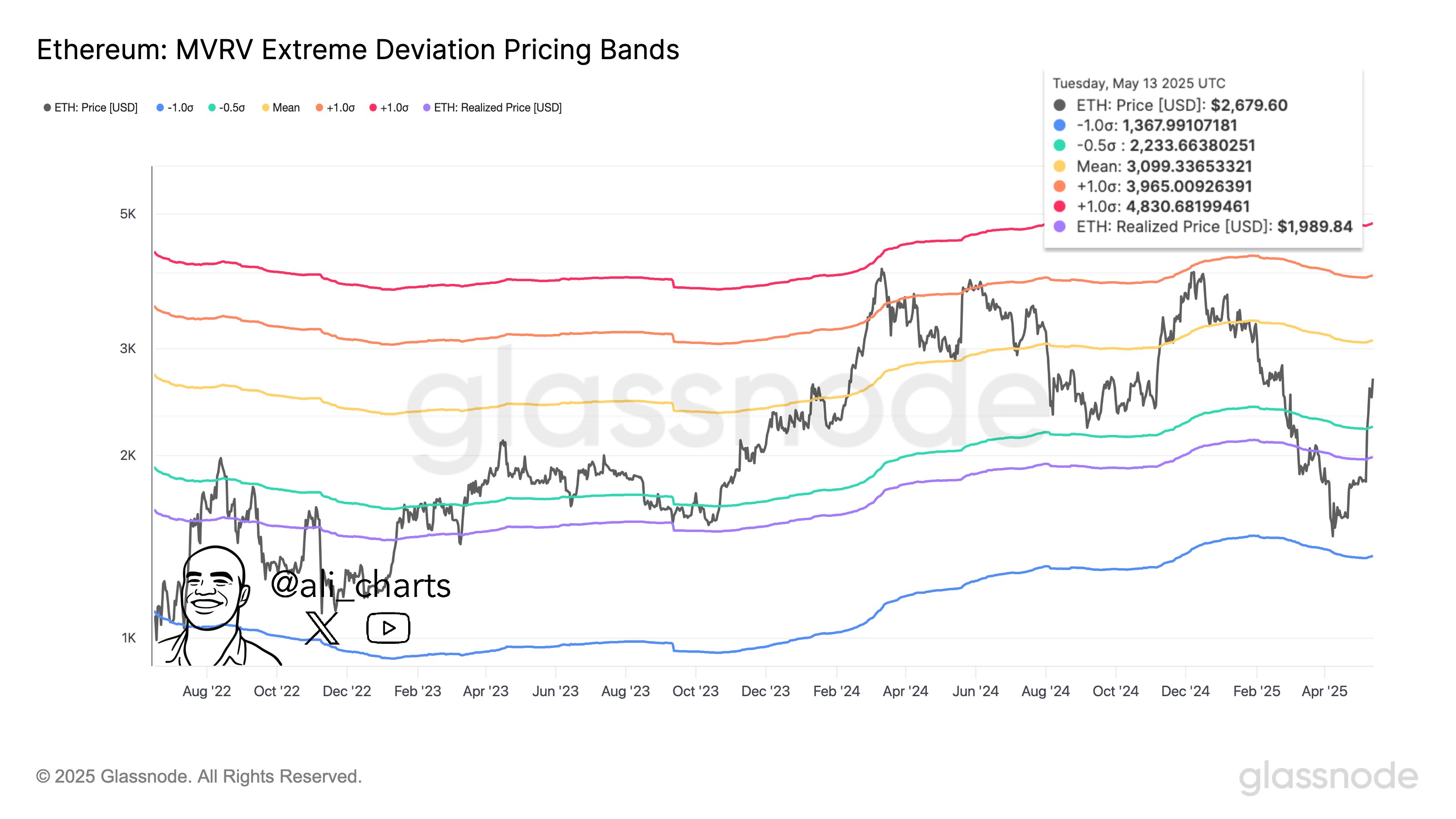

In a separate put up on X, veteran crypto analyst Ali Martinez pointed to Ethereum’s Market Worth to Realized Worth (MVRV) excessive deviation pricing bands. He emphasised that ETH should maintain above $2,200 to take care of bullish momentum. Ought to this degree maintain, Martinez believes ETH may goal $3,000, or probably even $4,000, if shopping for stress strengthens.

The place Is ETH Headed? Analysts Weigh In

Ethereum’s spectacular efficiency of late has attracted consideration from a number of crypto analysts, who at the moment are speculating the digital asset’s future worth trajectory. In accordance with crypto analyst Ted Pillows, ETH’s 12-hour chart not too long ago confirmed a Golden Cross, a bullish sign that usually precedes main worth rallies.

Associated Studying

In one other evaluation, Pillows forecasted that ETH may very well be eyeing a transfer to $4,000, noting that the asset has traded inside a large symmetrical triangle since Q3 2020. The $4,000 degree lies slightly below the triangle’s higher boundary.

In distinction, crypto analyst Gianni Pichichero warned of a possible retracement to $2,350, citing the emergence of decrease lows on Ethereum’s each day chart as a bearish sign. At press time, ETH trades at $2,500, up 3.6% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, X, and TradingView.com