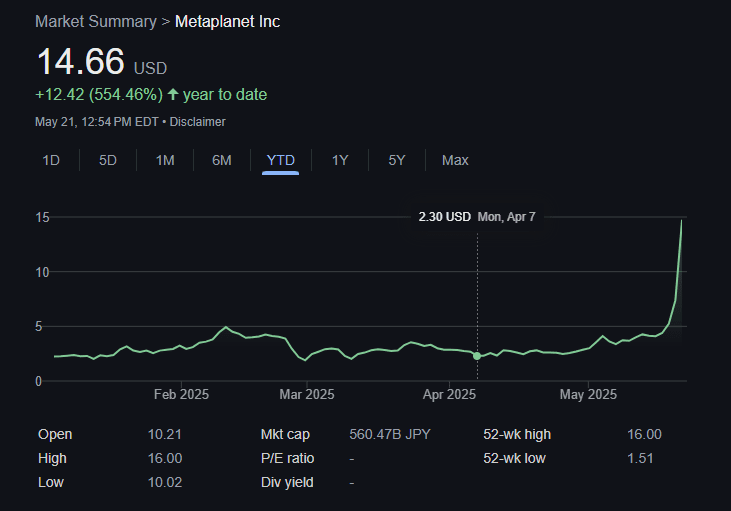

Metaplanet Inc., Japan’s main Bitcoin treasury firm, surged to a brand new all time excessive in market capitalization this week, propelled by Bitcoin’s personal historic ATH. The agency’s aggressive Bitcoin acquisition technique, modern financing, and rising investor confidence have pushed its valuation to ¥470.3 billion, up 554.5% year-to-date, intently monitoring Bitcoin’s surge previous its new ATH of $109,500 at this time.

In simply over a 12 months, Metaplanet has expanded its holdings from 98 BTC to 7,800 BTC (as of Might 19, 2025), acquired at a mean worth of $103,873 per coin. That stash is now price over $800 million, as Bitcoin’s record-breaking run this 12 months.

The newest rise adopted the corporate’s announcement of finishing the complete train of its thirteenth to seventeenth collection of inventory acquisition rights below its modern “21 Million Plan.” This fairness financing marketing campaign raised ¥93.3 billion in simply 60 buying and selling days, fueling extra Bitcoin purchases, with out diluting shareholder worth. In a uncommon transfer, these MS Warrants have been issued at a 6.8% premium over the share worth on the time.

Since announcing its itemizing on the OTCQX Market, Metaplanet’s progress has been relentless. “We’re thrilled to start buying and selling on the OTCQX Market, enabling higher entry for U.S. traders to take part in Metaplanet’s journey,” stated the President of Metaplanet Simon Gerovich. “As Asia’s solely devoted Bitcoin Treasury Firm, this step displays our dedication to advancing Bitcoin adoption globally whereas enhancing shareholder worth.”

Metaplanet’s progress is greater than only a case of excellent timing; it displays a robust, deliberate alignment with Bitcoin’s worth motion. Since shifting to a Bitcoin-focused technique in 2024, the corporate has posted spectacular quarterly BTC yields of 41.7%, 309.8%, 95.6%, and 47.8%. These returns have helped drive its internet asset worth up by 103.1 instances and its market capitalization by 138.1 instances, following Bitcoin’s speedy climb.

In Q1 FY2025, Metaplanet reported its strongest monetary outcomes but. Income elevated 8% quarter-over-quarter to ¥877 million, whereas working revenue rose 11% to ¥593 million. Web revenue surged to ¥5.0 billion, complemented by unrealized positive aspects of ¥13.5 billion from its Bitcoin holdings, additional strengthening the corporate’s steadiness sheet.

Though Bitcoin costs dipped briefly on the finish of March, inflicting a ¥7.4 billion valuation loss, Metaplanet swiftly recovered as BTC surged to new document ranges. This robust reference to Bitcoin’s efficiency has led many traders to make use of Metaplanet as an funding car to get Bitcoin publicity on the Tokyo Inventory Trade.