Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

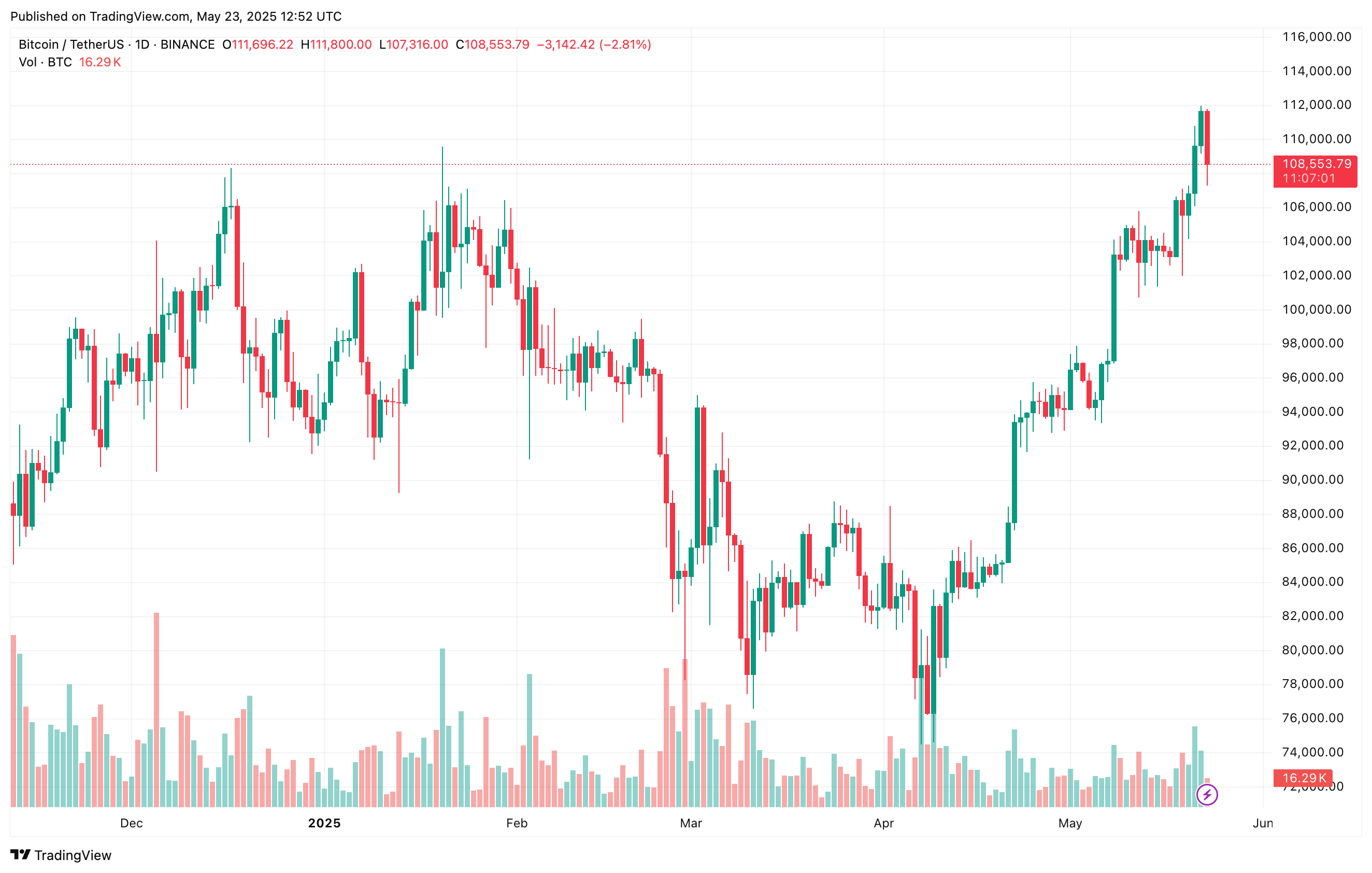

As Bitcoin (BTC) hit a brand new all-time excessive (ATH) of $111,980 on Binance crypto trade yesterday, technical information means that the newest BTC rally is being dominated by consumers. If this development continues, BTC might even see additional value appreciation within the close to time period.

Patrons Regain Management Of Bitcoin Spot Market

In response to a latest CryptoQuant Quicktake publish by crypto analyst ibrahimcosar, consumers look like dominating the BTC spot market. The analyst noticed that the Bitcoin Spot Taker Cumulative Quantity Delta (CVD) has shifted again into inexperienced territory.

For the uninitiated, Bitcoin Spot Taker CVD measures the distinction between taker purchase and taker promote volumes on spot exchanges over time. A rising Spot Taker CVD signifies that aggressive consumers are dominating the market, signalling potential bullish momentum.

Associated Studying

BTC Spot Taker CVD turning inexperienced is signficant. Most notably, it means purchase orders have regained dominance after an prolonged interval through which promote orders led the market. The next quantity of purchase orders over time means that Bitcoin’s present bullish momentum could persist.

As proven within the chart shared by ibrahimcosar, the CVD remained principally crimson for almost all of Q1 2025 – indicating robust promoting stress. This promoting habits aligned with BTC’s value motion, which noticed the asset fall from its earlier ATH in January to a low of round $76,000 in April.

The truth that BTC’s Spot Taker CVD has turned inexperienced whereas the asset is setting contemporary ATHs makes this development particularly noteworthy. It signifies that consumers are prepared to build up BTC even at traditionally excessive costs, possible in anticipation of continued upside.

That mentioned, latest value motion would possibly briefly interrupt BTC’s momentum. In an X publish, crypto analyst Ali Martinez advised that BTC may quickly break down from its present vary of $110,400 to $111,100.

A Totally different Type Of Rally

Sometimes, BTC hitting a brand new ATH is normally met with wider market euphoria, resulting in a pointy value decline that catches most buyers off-guard. Nevertheless, consultants opine that the present rally is completely different from earlier cycles.

Associated Studying

Latest evaluation by CryptoQuant contributor Crazzyblockk suggests that new and short-term BTC buyers are sitting on substantial unrealized income, and never exhibiting any indicators of panic promoting amid the cryptocurrency’s value surge to new highs.

Equally, whale response to BTC’s bullish value trajectory has been blended. Whereas new whales have been taking main income in the course of the ongoing rally, outdated whales have resisted promoting their holdings, exhibiting minimal promoting exercise.

Lastly, the impartial funding charges within the BTC futures market reinforce the concept the present rally is extra natural and fewer pushed by hypothesis than these previously. At press time, BTC trades at $108,553, down 2.6% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, X, and Tradingview.com