Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin surged previous its earlier all-time highs this week, reaching $112,000 on Thursday after breaking via resistance on Wednesday. The transfer marked a historic second for the market, solidifying bullish momentum and pushing BTC into a brand new worth discovery part. Nonetheless, the thrill was short-lived. Following feedback from US President Donald Trump, who threatened to impose a 50% tariff on European Union imports, international markets turned cautious, inflicting a broad risk-off sentiment that despatched Bitcoin costs decrease.

Associated Studying

The sell-off got here swiftly, pulling BTC again under native highs as buyers reacted to rising geopolitical and financial uncertainty. Whereas this retracement isn’t uncommon after such a robust rally, it underscores the sensitivity of crypto markets to macro headlines.

Prime analyst Large Cheds shared a technical perspective, noting that Bitcoin has now returned to the every day EMA 8. Holding this shifting common might sign that bulls stay in management and that this pullback is just a part of a healthy consolidation.

Bitcoin Regular As Market Uncertainty Grows

Bitcoin continues to indicate resilience within the face of persistent macroeconomic uncertainty. As US Treasury yields stay elevated and volatility sweeps throughout international inventory markets, BTC has managed to carry robust after lately pushing into new all-time highs. Whereas many threat belongings falter beneath these circumstances, Bitcoin is proving its narrative as a macro hedge, attracting curiosity from institutional and retail buyers alike.

Nonetheless, regardless of its current breakout to $112,000, the rally has not but been confirmed as a sustainable bullish part. Analysts broadly agree {that a} clear break above $115,000 is crucial to set off the following leg of worth discovery. With out that affirmation, the present transfer could possibly be seen as an overextension, particularly amid broader market instability.

Cheds shared a key technical insight this week, noting that Bitcoin is now again on the every day EMA 8 stage—a shifting common that has acted as dependable assist because the $80K vary. This means that the present pullback could possibly be a wholesome retest of pattern assist quite than the beginning of a deeper correction.

If BTC manages to bounce from this stage, bullish momentum might resume shortly. But when the EMA 8 fails, draw back threat might improve, particularly if conventional markets proceed to slip. For now, all eyes stay on how Bitcoin reacts at this technical crossroads.

Associated Studying

BTC Retests Key Degree As Uptrend Pauses

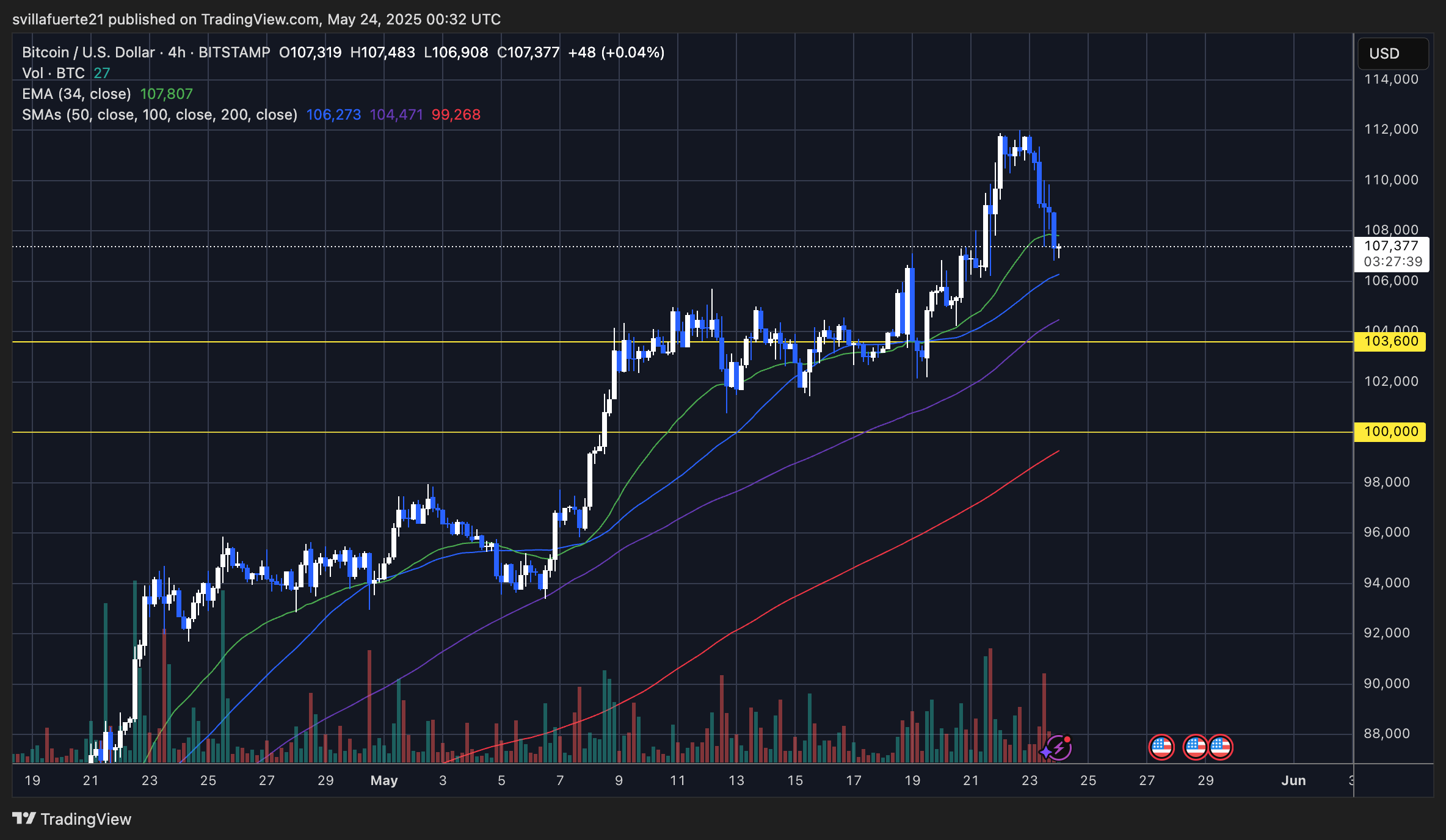

Bitcoin is at the moment retesting key technical ranges following its sharp rally to a brand new all-time excessive close to $112,000. As proven within the 4-hour chart, BTC has pulled again to the 34-period EMA (at the moment round $107,800), a stage that has served as dependable dynamic assist throughout this uptrend. The most recent candle motion reveals patrons stepping in barely above this space, suggesting it’s nonetheless holding.

Value can also be hovering simply above the 50-SMA at $106,273, reinforcing this zone as a confluence of assist. Quantity has picked up barely on the pullback, which might point out wholesome profit-taking quite than panic promoting if this stage holds, a continuation towards the earlier excessive, and probably a push above $112K stays on the desk.

Associated Studying

Nonetheless, if the assist fails and BTC dips under $106K, eyes will shift towards the following main horizontal assist at $103,600. A drop to this area would nonetheless be technically legitimate throughout the broader uptrend however might shake short-term bullish momentum.

Featured picture from Dall-E, chart from TradingView