Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Whereas Bitcoin and different main cryptocurrencies have surged to new all-time highs, Tron (TRX) has remained in a decent consolidation vary. Regardless of the broader market’s bullish momentum, TRX continues to be buying and selling practically 66% beneath its early December peak. Nevertheless, this lagging value motion has not gone unnoticed—buyers and analysts are more and more watching Tron as a possible breakout candidate.

Associated Studying

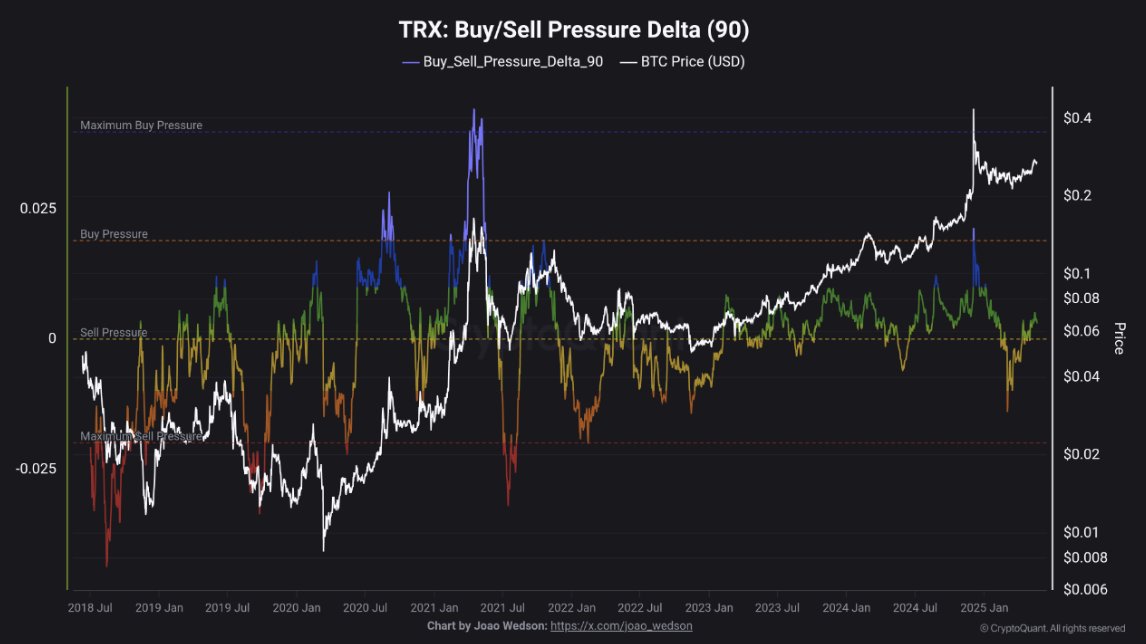

As one of many top-performing Layer-1 blockchains over the previous yr, Tron’s fundamentals stay sturdy. The community continues to steer in stablecoin settlement quantity and person exercise, positioning it properly for renewed upside if altcoins comply with Bitcoin’s lead. Latest on-chain information from CryptoQuant provides to the optimism: the Purchase/Promote Stress Delta, which measures internet shopping for or promoting exercise over the previous 90 days, exhibits that TRX has re-entered a shopping for strain zone.

Traditionally, this sign has preceded bullish value actions, particularly when mixed with sturdy fundamentals and enhancing market sentiment. If shopping for strain persists and value breaks above present resistance ranges, Tron might stage a major rally to meet up with the broader market. For now, all eyes are on whether or not this fresh demand can spark TRX’s subsequent leg increased.

Tron Holds Sturdy As Bullish Momentum Rebuilds

Tron (TRX), one of the crucial resilient altcoins lately, continues to point out energy regardless of a difficult setting for many non-Bitcoin belongings. Since late 2022, TRX has adopted a gradual uptrend, defying broader market corrections and sustaining sturdy on-chain fundamentals. Now, the asset consolidates close to important technical ranges, making ready for what might be its subsequent leg upward.

Though Bitcoin has clearly led the present cycle—hitting new all-time highs and attracting the vast majority of capital—many altcoins like Tron are nonetheless lagging. This divergence has led a number of analysts to query whether or not an altseason continues to be on the desk. Most imagine it is a Bitcoin-dominant cycle, particularly given the influx to BTC ETFs and macroeconomic uncertainty. Nevertheless, hope stays for a rotation into altcoins.

Supporting that optimism, CryptoQuant insights reveal that TRX has returned to a shopping for strain zone. The Purchase/Promote Stress Delta exhibits a transparent transition out of the promoting strain space. Demand is as soon as once more exceeding provide, favoring bulls.

Importantly, TRX has not but reached the historic thresholds that usually precede value tops. This means that there’s nonetheless room for development earlier than warning units in. If the broader market helps a rotation, Tron might emerge as a standout Layer-1 performer as soon as once more, particularly as merchants seek for sturdy setups past Bitcoin.

Associated Studying

Technical Evaluation: Bulls Defend Greater Lows Above Help

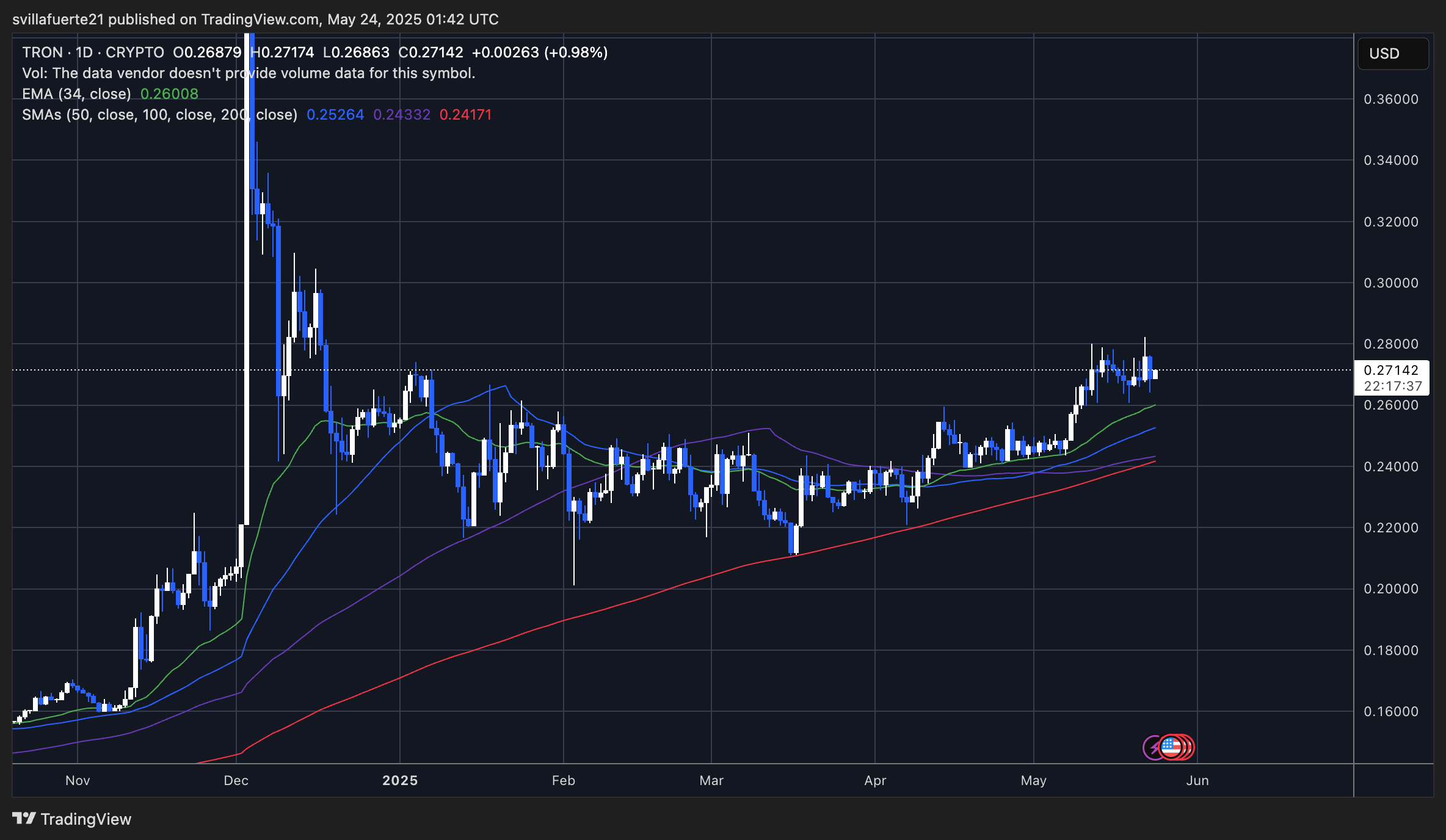

The each day chart for Tron exhibits that the asset is consolidating after a robust push towards the $0.28 resistance zone. Value motion has maintained a transparent bullish construction since early April, with increased lows forming constantly alongside the 34-day EMA ($0.26), which now acts as dynamic assist. The 50, 100, and 200 SMAs are all trending upward and tightly aligned beneath the present value, signaling long-term bullish alignment.

TRX stays in a short-term consolidation vary between roughly $0.26 and $0.28. The worth just lately examined this higher boundary twice however failed to interrupt by with sturdy momentum. Nevertheless, assist at $0.26 has held firmly, suggesting patrons are nonetheless in management.

Associated Studying

To substantiate a breakout, bulls should decisively push the worth above $0.28 with increased quantity, which might open the door to a transfer towards $0.30 and doubtlessly retest December’s highs close to $0.36. On the draw back, shedding $0.26 would weaken this setup and sure set off a drop towards the $0.2430 area, the place the 100 SMA at the moment sits.

Featured picture from Dall-E, chart from TradingView