Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum’s latest worth momentum, alongside with the rest of the market, stored buyers on edge through the week because it pressed nearer towards the $2,800 stage. Nonetheless, Ethereum struggled to push past $2,750 through the week, briefly hitting resistance as bulls tried to increase the present uptrend.

Apparently, on-chain knowledge exhibits that this can be a response to a significant cluster of purchase ranges round $2,800, which can improve sell-side strain within the coming days.

Associated Studying

$2,800 Zone Heats Up With Investor Value Foundation Cluster

After rebounding from a low near $1,600 in April, Ethereum recovered greater than half of its losses final week from its peak close to $3,800 in December 2024. In response to on-chain analytics platform Glassnode, there’s a vital accumulation of Ethereum provide held by buyers who purchased in close to the $2,800 worth vary. This focus, visualized in Glassnode’s cost-basis heatmap, exhibits a notable density of pockets exercise exactly at this stage.

The implication of this focus is straightforward: a lot of ETH holders who’ve been underwater since early 2025 are lastly seeing an opportunity to exit at breakeven because the Ethereum worth approaches $2,800. As such, promoting strain might improve because the Ethereum worth approaches this stage. The logic is that these buyers who’ve been underwater might use this rally to safe impartial exits. That type of sell-side strain can act as a cap on the rally, until demand is robust sufficient to soak up the provision hitting the market.

The heatmap under exhibits a big cluster of provide density just under $2,800, which Ethereum should decisively overcome to continue its path toward reclaiming $3,000.

Some Resistance Above, However Sturdy Help Beneath

Given the opportunity of the $2,800 stage performing as a difficult worth ceiling through the week, completely different on-chain knowledge exhibits Ethereum having fun with robust support beneath the current price level.

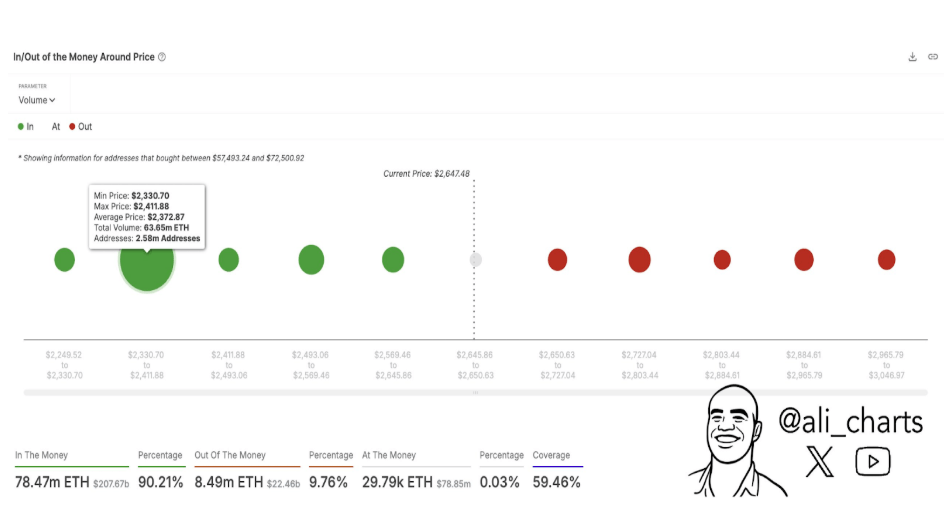

In response to a post on X by crypto analyst Ali Martinez, blockchain knowledge from Sentora (previously IntoTheBlock) exhibits that Ethereum holders have constructed a strong demand zone between $2,330 and $2,410. This space hosts 2.58 million addresses holding over 63.65 million ETH, making it an vital assist ground.

On the time of writing, Ethereum is buying and selling round $2,500, down by 2% up to now 24 hours. The present worth vary places the worth of the biggest altcoin squarely between a band of promoting strain overhead and a strong cushion of demand under.

Associated Studying

Apparently, there are not any vital resistance partitions apart from the associated fee foundation ranges round $2,800, which means {that a} convincing breakout above $2,800 may push the Ethereum worth quickly towards $3,000. The steadiness of possibilities now rests on whether or not bullish momentum can break via the resistance cluster or whether or not a pullback towards the $2,370 zone will reset the rally.

Featured picture from Unsplash, chart from TradingView