Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Hyperliquid has rapidly turn out to be a foremost character within the crypto area after it grew to become the main decentralized finance (DeFi) trade for perp buying and selling. As its recognition has grown, so has the value of its native HYPE token. This has seen it rally even at a time of bearish divergence within the crypto market, moving up by more than 50% in one week to succeed in new all-time highs.

Components Driving The Hyperliquid Value

The primary driver behind the Hyperliquid value pushing to new all-time highs has been the rise in consideration being paid to the platform. As crypto traders are pivoting towards extra decentralized platforms for his or her perpetual buying and selling actions, HYPE’s mindshare has grown exponentially over the previous few months.

Associated Studying

This rising curiosity translated to a significant surge within the platform’s buying and selling quantity over the previous few weeks. Most notable have been the billion-dollar bets placed by James Wynn, who has rapidly risen to turn out to be the most well-liked crypto dealer on Hyperliquid. His trades garnered the curiosity of hundreds, placing extra eyes on the platforms as onlookers stood by to see the end result of his trades.

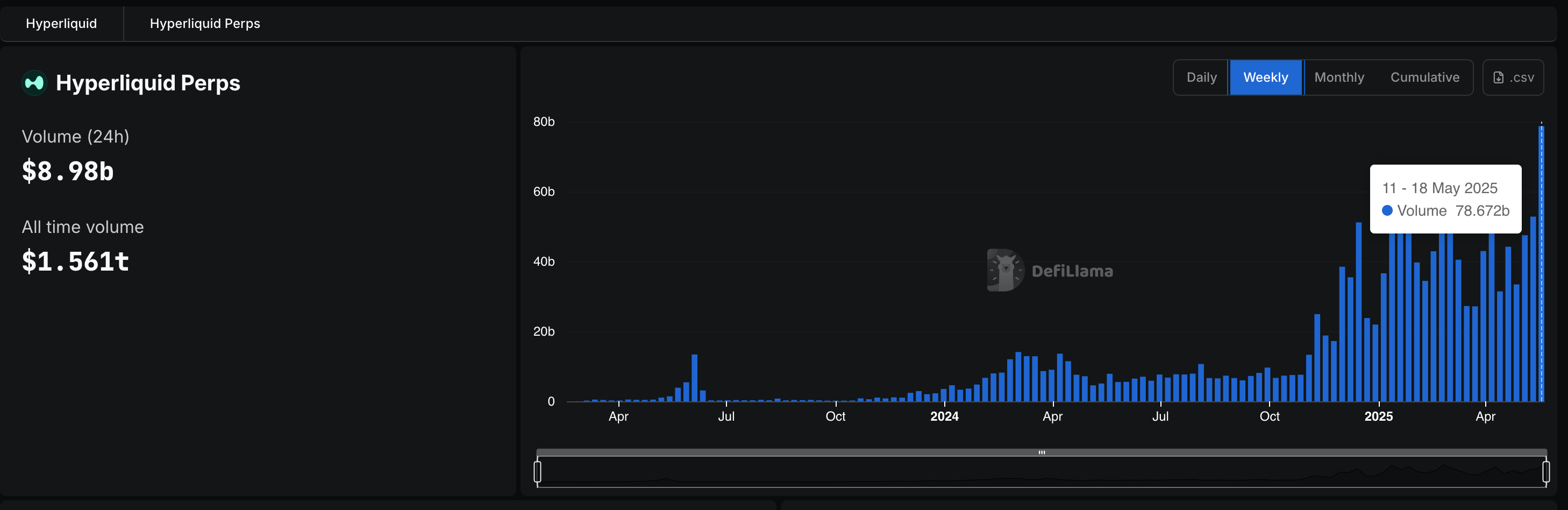

Particularly, during the last week, the platform recorded its highest weekly volume since it was launched, reaching $78.672 billion in buying and selling quantity between Could 11 and Could 18, 2025. Each day buying and selling volumes have additionally not been not noted, persistently crossing the $2 billion mark each day.

Its highest each day buying and selling quantity but was recorded on Could 21, 2025, with $17.731 billion commerce on the platform. Cumulatively, the Hyperliquid platform has reached $1.156 trillion in quantity in three years of operation, DefiLlama data exhibits.

Different main developments that the platform has seen is the rise within the open curiosity. The platform celebrated a brand new all-time excessive after open curiosity crossed the $10.1 billion mark on the platform. The quantity of USDC locked on the platform additionally climbed to $3.5 billion, with $5.6 million in charges generated in solely a 24-hour interval. In a single week, the platform was in a position to generate over $22 million in charges alone.

Associated Studying

By itself, the HYPE price remains to be displaying plenty of bullish momentum regardless of already rising 50% in a single week. Each day buying and selling volumes crossed $460 million on Could 26, in line with knowledge from CoinMarketCap. Crypto whales have been particularly lively throughout this time, as Lookonchain reported three whales spending $5.33 million to purchase HYPE on Monday.

With volumes rising and costs going up, it means that plenty of the amount is definitely from consumers. If this shopping for stress continues, then it’s doubtless that the value sees additional upside earlier than placing in a correction.

Featured picture from Rigzone, chart from TradingView.com