Saifedean Ammous, CEO of Saifedean.com and writer of The Bitcoin Normal, delivered a data-driven keynote on the Bitcoin 2025 Conference, warning of inevitable U.S. greenback decline and positioning Bitcoin as the one rational hedge. “Default, devaluation, or default by devaluation are inevitable,” Ammous declared, including pointedly, “Tether can’t repair what a century of fiat democracy ruined.”

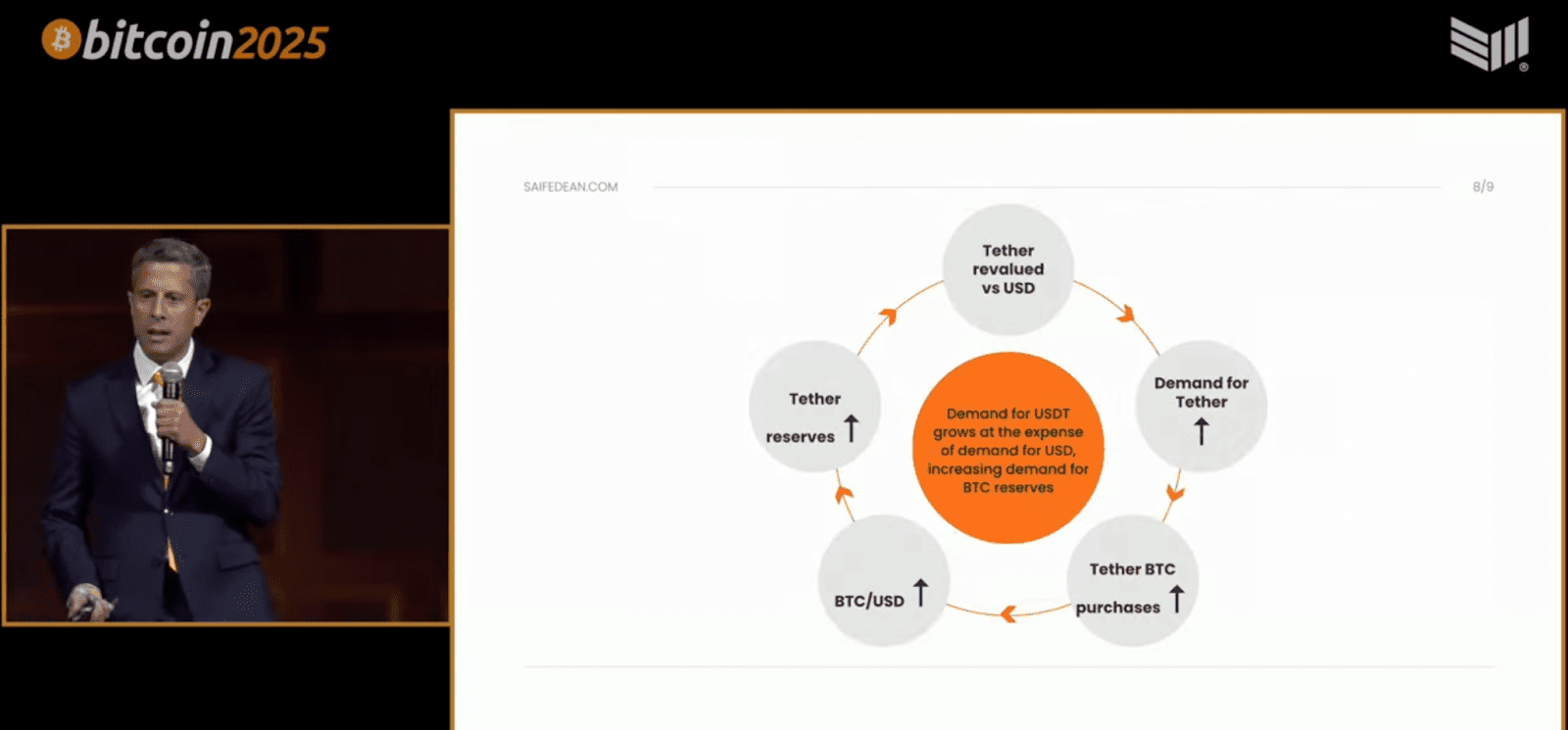

Utilizing projections and movement charts, Ammous argued that Tether’s Bitcoin strategy may quickly outpace its U.S. greenback reserves. “Then Tether will break the peg upwards,” he stated, predicting a state of affairs the place 1 USDT may equal 1.02 USD and proceed revaluing because the greenback weakens. “Tether turns into a comparatively stablecoin because the greenback declines.”

The speak emphasised what Ammous described as a self-reinforcing loop: as USDT demand rises, so does Tether’s want for BTC reserves, which drives up Bitcoin costs—resulting in much more revaluation. “This can be a important influence available on the market,” he stated. “Shopping for bitcoin is the neatest factor anyone may do.”

In a ultimate sweeping assertion, Ammous forecasted the tip of the USD period. “Ultimately, USD reserves go to zero subsequent to BTC reserves,” he stated. “USDT retains getting revalued upward till it’s redeemable in bitcoin. USDT → BTCT.” He referred to as Tether a “transition financial system” and concluded, “Even probably the most bullish state of affairs for USD is way more bullish for BTC.”

To Ammous, the greenback is locked in a downward spiral whereas Bitcoin, with its “quantity go up know-how,” continues rising. “The factor that goes up goes to overhaul the factor that goes down,” he stated—summarizing his complete argument in a single sentence.