Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

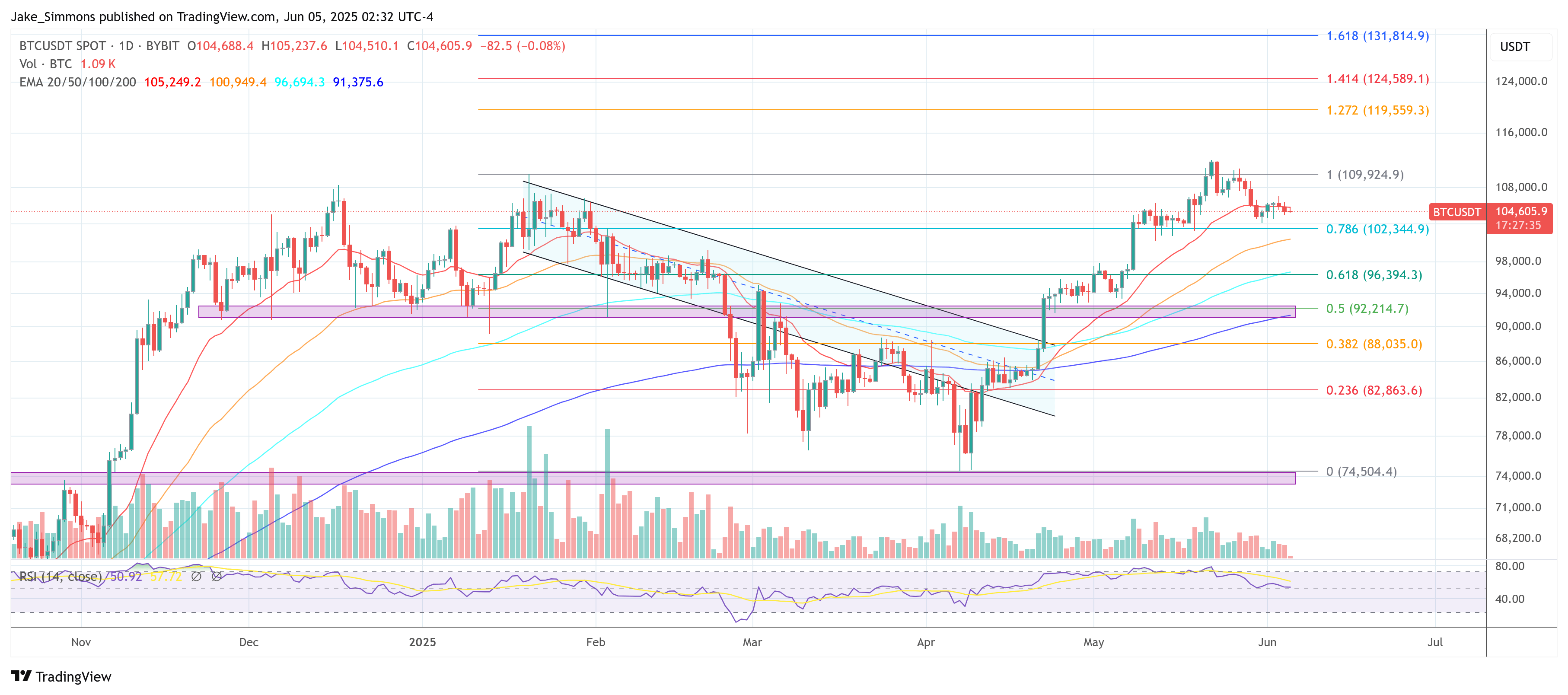

Bitcoin is drifting simply above $105,000 on June 5, its lowest realized volatility in nearly two years, but Swan, the Los-Angeles-based “Bitcoin-only” monetary providers agency, contends the market is on the verge of its most radical re-pricing ever.

The Final Likelihood To Purchase?

In a X thread on Wednesday evening, the corporate argued that the acquainted four-year boom-and-bust cadence is giving solution to “the final rotation”—a silent switch of cash from retail speculators to establishments whose funding horizons stretch many years. “Individuals much less dedicated to the long run are exiting […] and an entire new class of traders is getting into,” Swan is quoting Michael Saylor, framing the hand-off from retail merchants to company treasuries, ETFs and multinationals resembling BlackRock and Constancy.

To date, 2025 has defied the script. The third calendar yr of each prior cycle—2013, 2017 and 2021—delivered the vertical strikes that outlined these eras. This yr has supplied “large strikes, but in addition shallower corrections and longer intervals of sideways chop,” Swan writes, conceding that the value motion “is boring folks.”

Associated Studying

The agency’s thesis is that boredom masks an invisible provide squeeze: long-time holders taking income above $100,000 whereas “long-only consumers,” in Swan’s phrases, methodically take up the float. “These corporations, they’re long-only consumers. Not merchants of Bitcoin,” Swan argues, underscoring the agency’s view that cash migrating into company vaults are successfully faraway from circulation.

The thread portrays three intertwined rotations: Between entities – Trustees, attorneys and early adopters are exiting; ETFs, companies and “sovereign-grade steadiness sheets” are stepping in.

Between intentions – Hypothesis provides solution to allocation. “This new wave of consumers isn’t speculating,” Swan writes. “They’re allocating.” Between generations. The Silent Era hoarded gold; Boomers compounded in equities; Gen X surfed tech; now Millennials, “getting into their peak accumulation years,” are “inheriting trillions—they usually’re selecting Bitcoin.”

Associated Studying

Provide dynamics, Swan contends, make these rotations irreversible. “When long-term capital meets inelastic provide, the float begins vanishing,” the agency warns. “That’s when issues get explosive.” The macro backdrop provides stress: Swan factors to a “uncommon and harmful break up” during which the US greenback is weakening whilst bond yields surge—an atmosphere, it says, that would funnel extra capital towards a impartial retailer of worth.

“This isn’t simply the subsequent cycle. It’s the tip of an period,” Swan concludes. “In case you’re promoting now, perceive you’re seemingly handing your Bitcoin to an establishment that plans to carry it indefinitely. As soon as it’s gone, you’re in all probability by no means getting it again.”

For Swan, the implication is stark. The obvious tranquility close to $105,000 is much less an indication of exhaustion than the quiet earlier than a everlasting liquidity occasion—one during which the marginal vendor disappears, the marginal purchaser by no means sells, and worth should ultimately mark greater to seek out equilibrium.

“Suppose twice,” Swan advises would-be profit-takers. “The float is drying up. The consumers are constructed totally different. That is the final Bitcoin rotation.” If the agency is correct, historical past just isn’t repeating a lot as culminating, and the market’s present stillness could quickly be remembered as the attention of a generational storm.

At press time, BTC traded at $104,605.

Featured picture created with DALL.E, chart from TradingView.com