Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Bitcoin (BTC) got here near slumping under the psychologically essential $100,000 mark final week, the short-term holders (STH) cohort began to point out indicators of weakening conviction within the main cryptocurrency, elevating fears of a deeper worth correction.

Bitcoin STH Concern Resurfaces

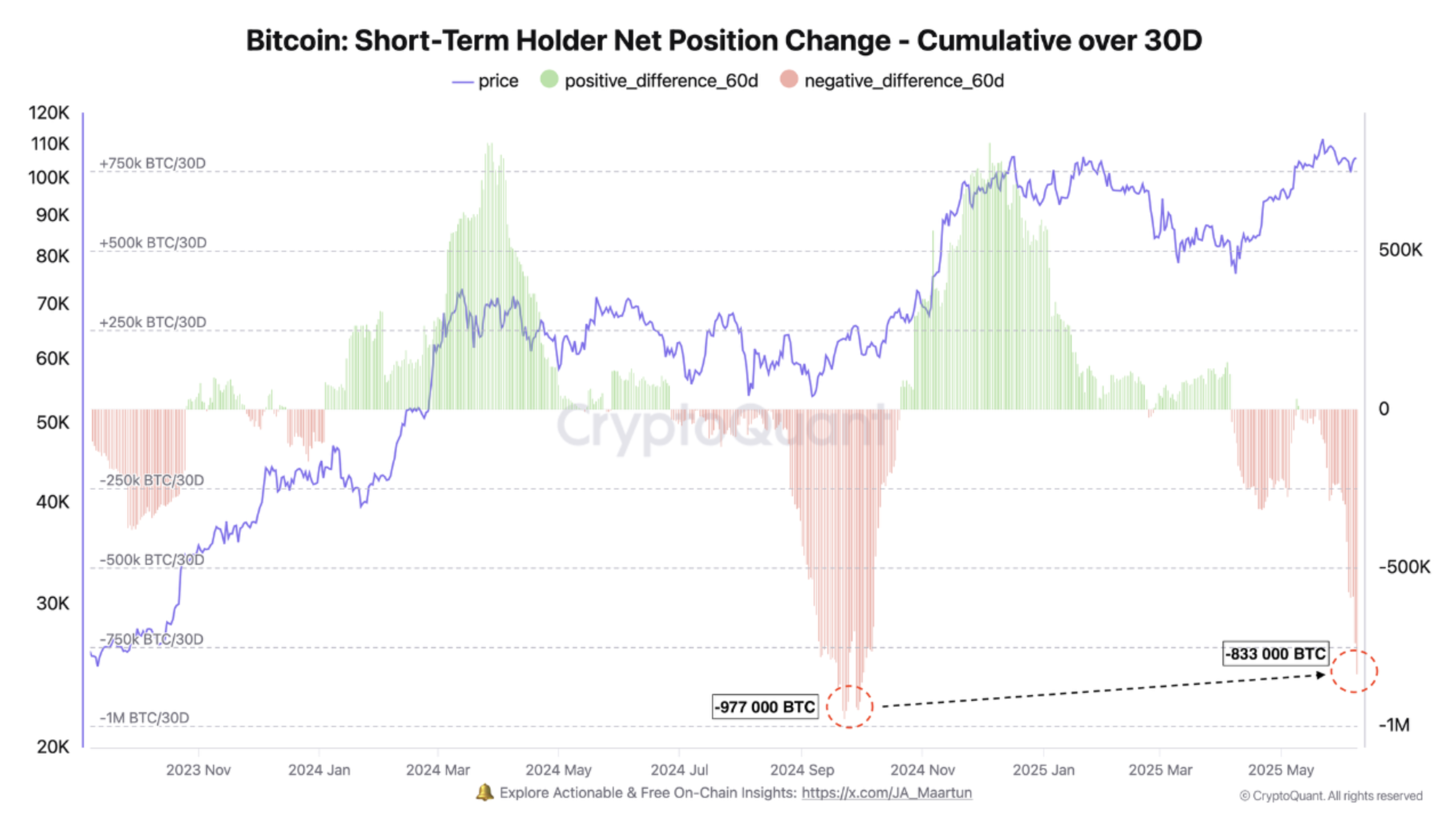

In response to a current CryptoQuant Quicktake submit by contributor Darkfost, Bitcoin STH’s internet place has turned sharply destructive over the previous month. This has occurred regardless of BTC holding above the $100,000 stage.

For the uninitiated, Bitcoin STH are traders who’ve held their BTC for lower than 155 days. They’re typically extra reactive to cost volatility and market sentiment, typically promoting throughout corrections or uncertainty.

Particularly, a cumulative internet place change of -833,000 BTC has been recorded amongst short-term holders throughout the ongoing pullback. By comparability, the April crash noticed a internet place change of round -977,000 BTC.

Associated Studying

Darkfost famous that present STH habits carefully resembles the exercise noticed throughout BTC’s temporary drop under $80,000 in April 2025, when the digital asset bottomed out at $74,508. The analyst wrote:

Since then, STH seem to have change into rather more delicate to market actions, and the current dip across the $100,000 mark was sufficient to set off renewed worry amongst this group of traders.

BTC Exhibiting Indicators of Reversal

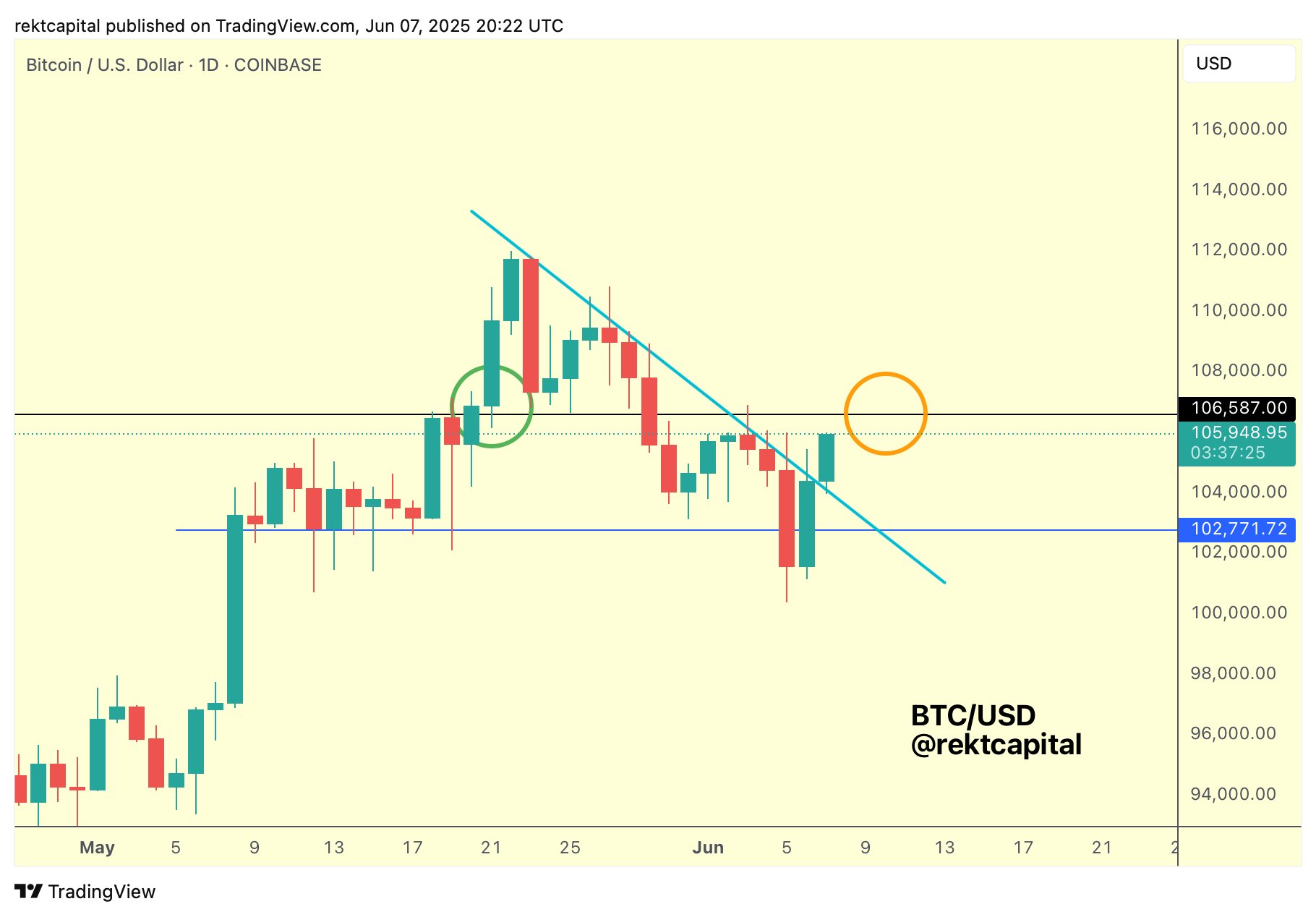

Though BTC misplaced momentum after reaching its newest all-time excessive (ATH) of $111,814, the main cryptocurrency regained power over the weekend – indicating a attainable reversal could also be underway.

Associated Studying

For instance, seasoned crypto analyst Ali Martinez famous that BTC has damaged by way of the important thing resistance stage at $106,600. In a current X submit, Martinez predicted that Bitcoin might rally to $108,300 and even $110,000 if present momentum continues.

In a separate X submit, fellow crypto analyst Rekt Capital shared the next Bitcoin each day chart, noting that the cryptocurrency not solely broke out of its two-week downtrend – highlighted in mild blue – however could now be turning that former resistance into a brand new assist stage.

In the meantime, a number of technical indicators additionally level to continued bullish momentum. Notably, Bitcoin’s Hash Ribbons have not too long ago flashed a chief shopping for sign.

Moreover, on-chain knowledge suggests that BTC might expertise a pointy upward transfer within the brief time period, probably pushed by a destructive funding charge on Binance. A protracted interval of destructive funding charges typically units the stage for a brief squeeze.

Regardless of the bullish outlook, some pink flags stay. Current knowledge shows that long-term holders are steadily exiting the market, whereas an inflow of retail traders might add volatility to the present rally. At press time, BTC trades at $107,627, up 1.9% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, X, and TradingView.com