Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

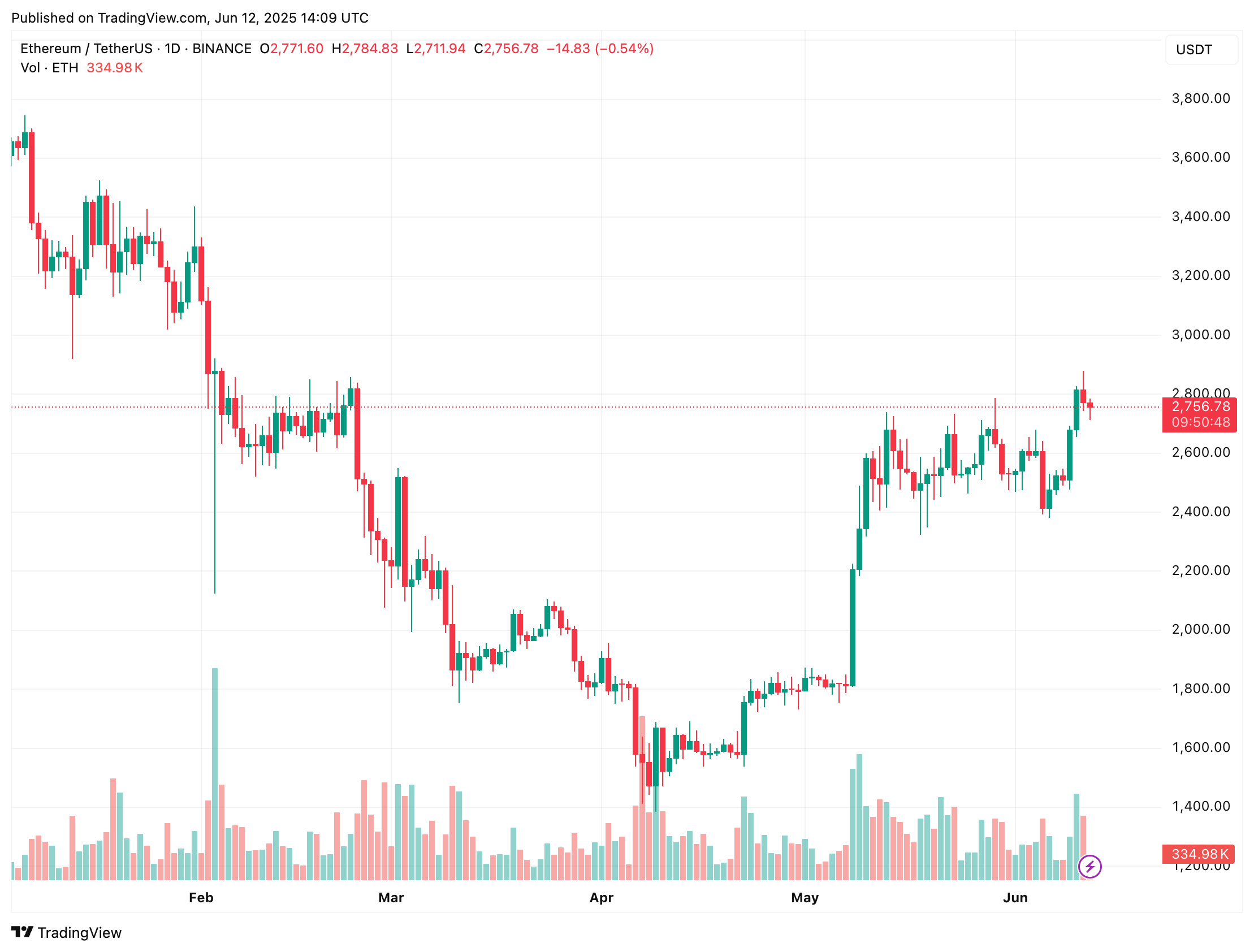

In response to current technical evaluation, Ethereum (ETH) could also be gearing up for a serious breakout that might propel the cryptocurrency near the $4,200 mark. In the meantime, ETH continues to draw rising institutional curiosity, with Ethereum exchange-traded funds (ETFs) outperforming their Bitcoin (BTC) counterparts.

Ethereum Headed For A Breakout?

In a current X publish, famous crypto analyst Titan of Crypto highlighted that ETH is climbing inside a large weekly broadening wedge construction. The analyst shared the next chart and advised that ETH may very well be focusing on the $4,200 degree – marking the highest of the wedge.

For the uninitiated, a broadening wedge is a chart sample characterised by diverging trendlines, the place worth makes larger highs and decrease lows, forming a megaphone-like form. It usually signifies rising market volatility and might sign a possible breakout, with the route relying on the prevailing pattern and breakout affirmation.

Associated Studying

Fellow crypto analyst Grasp of Crypto echoed an analogous outlook, stating that ETH is “establishing for a giant transfer,” particularly with over $2.2 billion briefly positions clustered close to the $3,000 degree.

If Ethereum breaks above $3,000, it might set off a brief squeeze, probably accelerating ETH’s rally. On the time of writing, ETH is buying and selling 43.7% beneath its all-time excessive (ATH) of $4,878, recorded in November 2021.

Capital flows additionally point out rising institutional curiosity in Ethereum. Crypto market commentator Ted Pillows just lately pointed out that spot ETH ETFs attracted $240.3 million in inflows yesterday, in comparison with $164.6 million for spot BTC ETFs.

The stronger efficiency of ETH ETFs means that capital could also be rotating from Bitcoin to Ethereum. It’s price noting that whereas BTC is up 54% since June 2024, ETH continues to be down 24.6% throughout the identical interval.

Crypto dealer Merlijn the Dealer shared the next month-to-month BTC/ETH chart exhibiting two consecutive pink candles, signaling a possible shift in momentum as BTC weakens relative to ETH. The dealer famous {that a} related capital rotation in 2020 preceded a “monster altseason.”

Issues Look Optimistic For ETH

Whereas altcoins like Solana (SOL), Tron (TRX), and SUI created recent ATHs in 2024, ETH’s efficiency did not reside as much as expectations. In consequence, the broader sentiment within the Etheruem ecosystem took a hit.

Associated Studying

Nonetheless, 2025 seems to be ushering in a extra favorable outlook. On-chain information reveals that ETH faces no main resistance till the $3,417 degree.

Moreover, ETH just lately flashed a golden cross on the every day chart – a bullish technical sign that might point out an impending rally. At press time, ETH trades at $2,756, down 1.7% prior to now 24 hours.

Featured picture from with Unsplash, charts from X and TradingView.com