Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Brewing tensions between Israel and Iran have triggered international de-risking throughout risk-on belongings, together with Bitcoin (BTC). The highest cryptocurrency by market cap is down 1.7% over the previous 24 hours. That mentioned, technical indicators nonetheless level towards a possible new all-time excessive (ATH) for BTC within the coming months.

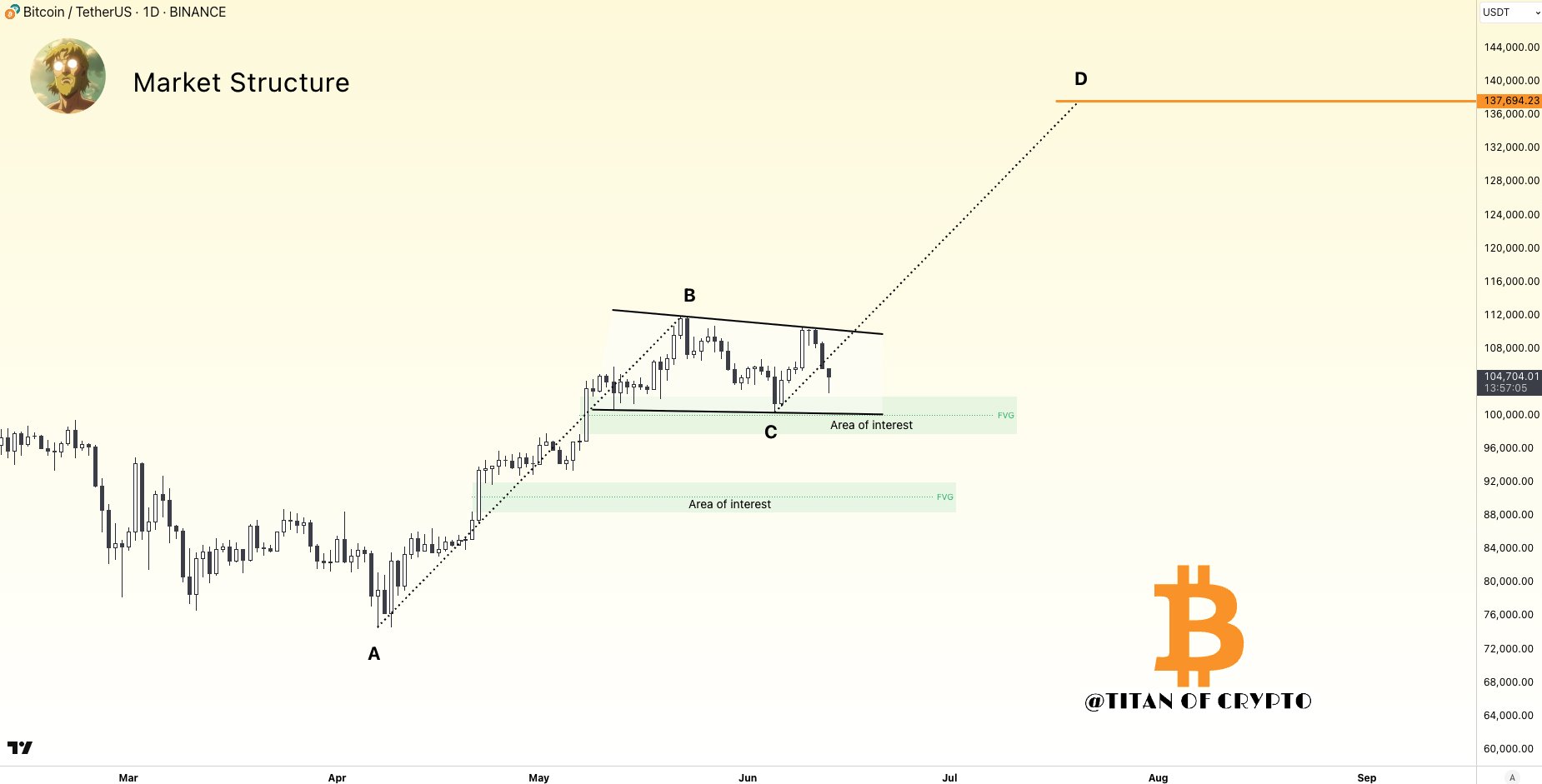

Bitcoin Tracing The ABCD Sample

In accordance with a current put up on X by crypto analyst Titan of Crypto, BTC seems to be following the ABCD sample. The analyst famous that Bitcoin is presently buying and selling inside a wedge formation and will goal as excessive as $137,000 if it breaks out.

For the uninitiated, the ABCD sample is a basic chart setup with 4 factors and three legs – AB, BC, and CD – the place AB and CD are sometimes equal in size, and BC serves because the retracement. It helps determine potential reversal zones and alerts when a value transfer could also be dropping momentum.

Associated Studying

A number of different technical indicators additionally level to a possible new ATH for BTC. As an illustration, crypto analyst Crypto Caesar shared the next 4-hour Bitcoin chart highlighting a bullish double bottom sample that implies BTC is primed for restoration.

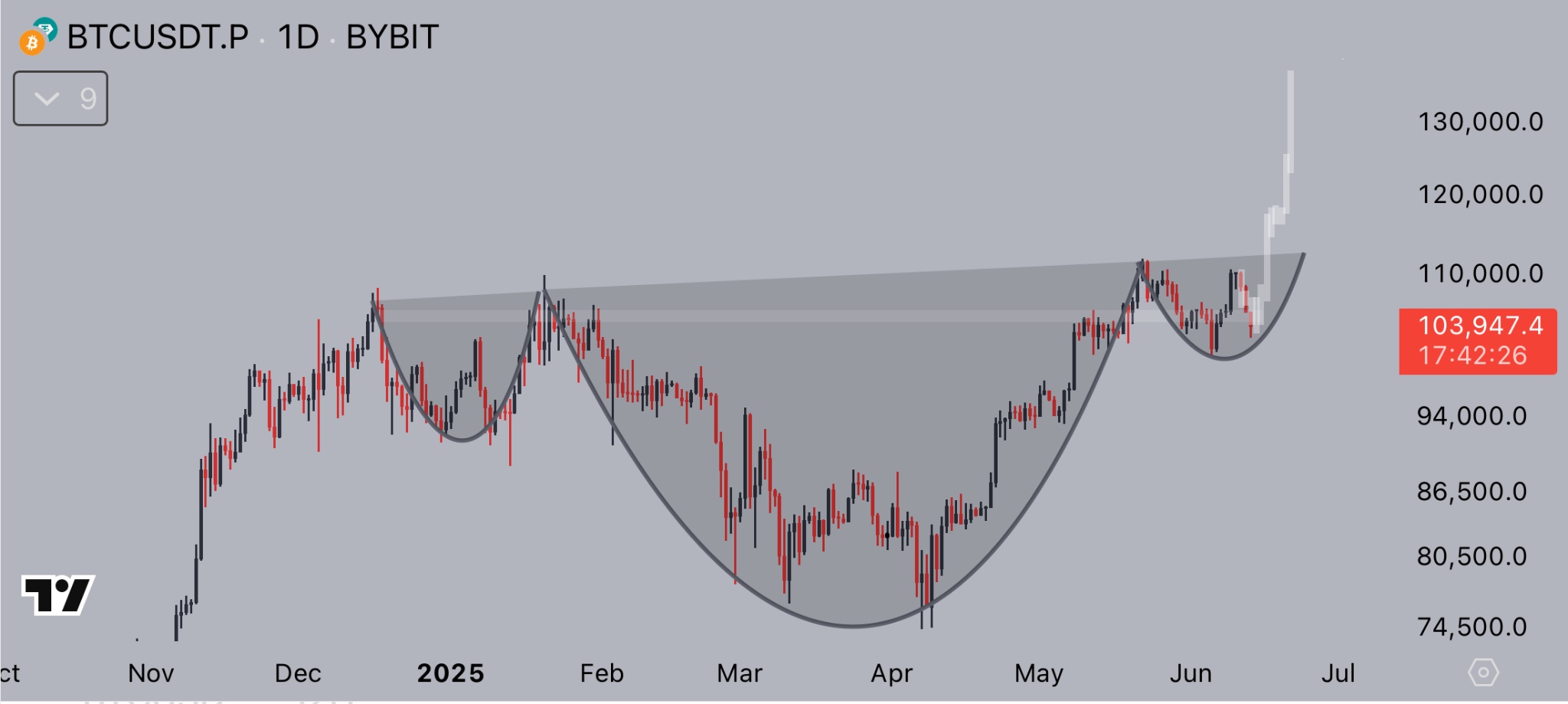

Fellow crypto commentator Jelle recognized a cup and deal with sample on the every day BTC chart. Jelle shared the next chart exhibiting that BTC has already shaped the “cup” and is now starting to form the “deal with,” which usually precedes a pointy upward transfer.

In the meantime, crypto dealer Merlijn the Dealer pointed to the Hash Ribbons – an on-chain indicator traditionally related to main rallies. Merlijn shared the next BTC every day chart, noting that the final 4 appearances of this sign preceded sturdy Bitcoin uptrends.

To elucidate, Hash Ribbons is an on-chain indicator that makes use of Bitcoin’s 30-day and 60-day hash price shifting averages (MA) to identify miner capitulation and restoration. A bullish sign seems when the short-term common crosses above the long-term one.

Are BTC Bears Regaining Floor?

Though BTC stays above the psychologically necessary $100,000 mark, some regarding indicators are starting to emerge. The cryptocurrency was not too long ago rejected from the $110,000 resistance stage once more, giving bears momentary management.

Associated Studying

Equally, on-chain knowledge shows that long-term holders are starting to exit the Bitcoin market which retail traders are beginning to take part. Such dynamics are sometimes noticed in the course of the late part of a bull cycle.

In parallel, short-term holders are showing indicators of declining confidence in BTC, as mirrored in current on-chain exercise. On the time of writing, BTC trades at $105,568, down 1.7% over the previous 24 hours.

Featured picture with Unsplash, charts from X and TradingView.com