Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is buying and selling simply above the essential $104K degree after enduring a number of days of promoting stress triggered by escalating tensions within the Center East. The latest assaults between Israel and Iran have injected contemporary volatility throughout monetary markets, however BTC has proven notable resilience. At present down about 5% from its all-time excessive of $112K, Bitcoin continues to commerce inside a broader consolidation vary as macroeconomic uncertainty persists.

Associated Studying

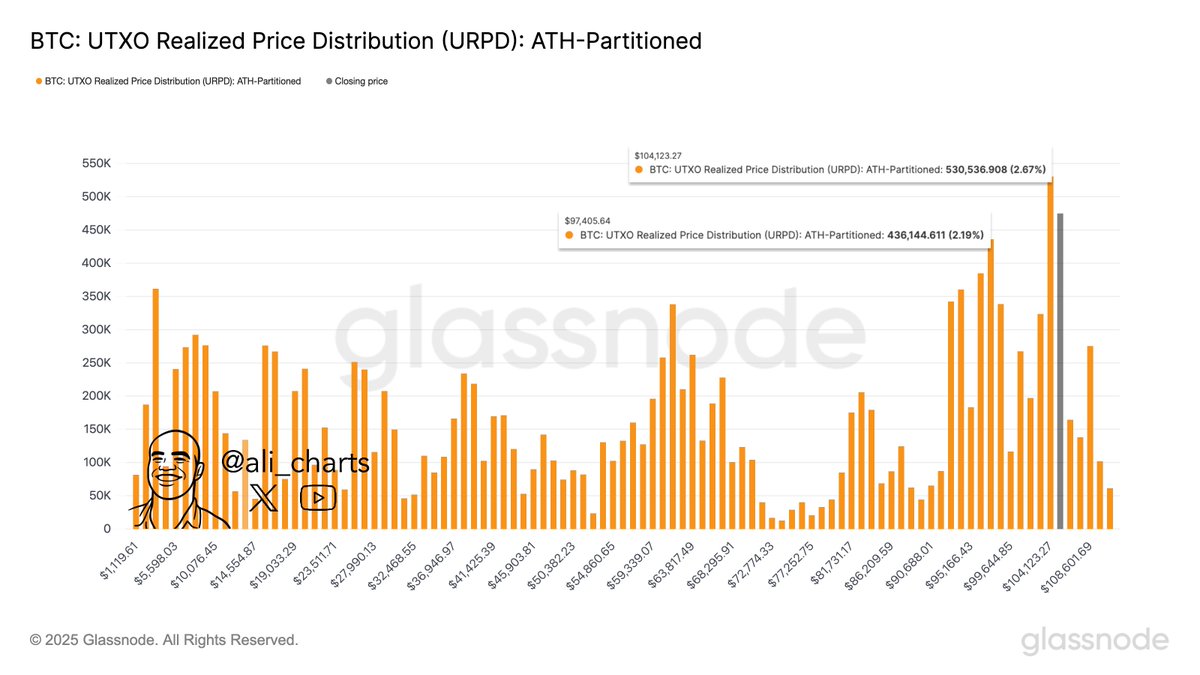

Regardless of the geopolitical instability and rising bond yields, Bitcoin’s construction stays bullish, with bulls defending key assist zones. In response to high analyst Ali Martinez, the $104,124 degree is an important threshold to look at. He highlights that this degree aligns with a powerful cluster of Unspent Transaction Outputs (UTXOs) based mostly on the Realized Worth Distribution metric. This means a heavy focus of patrons who acquired BTC at or close to this vary, probably reinforcing it as a stable assist base.

Holding above this degree may mark a turning level, paving the best way for an additional push towards value discovery. Nonetheless, a breakdown beneath this zone may set off a deeper correction towards decrease demand ranges. For now, all eyes stay on Bitcoin’s response to this key degree as world dangers proceed to evolve.

Bitcoin Holds The Line Above $100K Amid Geopolitical Dangers

Bitcoin is displaying notable resilience amid world turmoil, holding above the $100K mark regardless of rising uncertainty linked to escalating Center East tensions. Because the market heads into Monday, traders are bracing for probably unstable classes, relying on additional developments between Israel and Iran. A pointy rise in oil costs may add extra macro stress, making the beginning of the week a decisive second for threat belongings.

BTC continues to commerce inside a consolidation vary after falling 5% from its all-time excessive of $112K. Analysts extensively agree that Bitcoin is in a transitional part—both making ready for an explosive breakout into value discovery or setting the stage for a deeper retracement. Many consider {that a} confirmed breakout above $112K may set off the subsequent main leg larger, marking the start of a brand new enlargement cycle for your entire crypto market.

Nonetheless, warning stays essential at present ranges. Martinez pointed to key on-chain data from the UTXO Realized Worth Distribution, figuring out $104,124 as a pivotal assist zone. This value degree is the place a big quantity of BTC final moved, suggesting robust purchaser curiosity. If BTC holds this degree, it may kind a stable base for continuation. But when it breaks down, the subsequent space of curiosity lies round $97,405—probably sparking broader worry throughout the market.

Within the coming days, Bitcoin’s response to geopolitical information and macroeconomic alerts, notably oil value actions and bond yield reactions, will probably be essential. For now, the bulls stay in management, however the path ahead calls for shut consideration and calculated positioning.

Associated Studying

BTC Worth Evaluation: Bulls Defend Key Help

Bitcoin is at the moment buying and selling at $105,502, displaying indicators of power after defending the essential $103,600 assist degree. This value zone has acted as a constant ground over the previous week and continues to be a key pivot for short-term market construction. After a steep drop from the $112K excessive, BTC bounced off this assist with a powerful wick on excessive quantity, signaling purchaser curiosity and a possible short-term backside.

The chart reveals that Bitcoin is consolidating between $103,600 and $109,300, with the 50, 100, and 200-period SMAs converging simply above the present value, indicating a call level is close to. A transparent break above $106,800 may set off momentum to check $109,300 once more, whereas a failure to carry above $104,500 would expose BTC to draw back threat.

Associated Studying

Quantity stays comparatively muted in comparison with the spike throughout the June 13 drop, suggesting that a lot of the panic promoting has cooled for now. Nonetheless, value stays beneath the 200 SMA, reinforcing that bulls should reclaim this zone to substantiate continuation.

Featured picture from Dall-E, chart from TradingView