Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

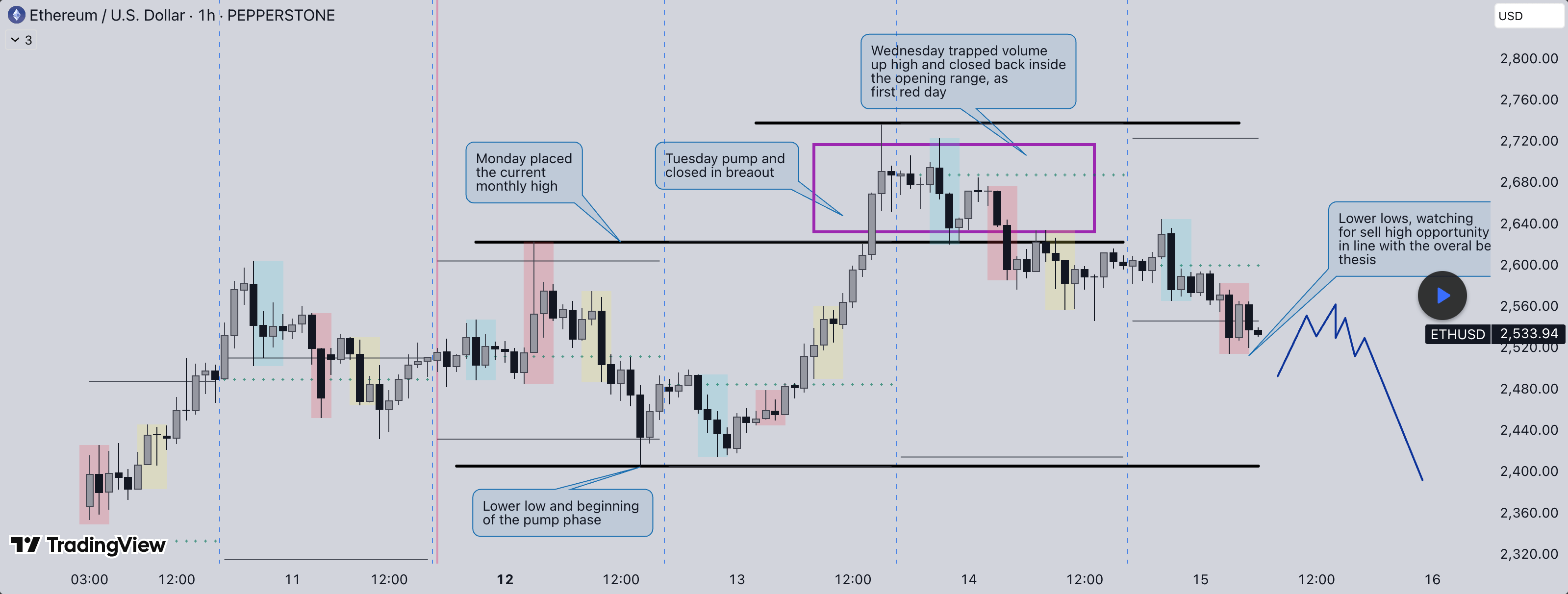

The Ethereum price has ranged low now after making a brand new month-to-month excessive again on Tuesday. This enhance had come as a much-needed reduction for the crypto market, which had watched the ETH value struggled whereas Bitcoin thrived. Nonetheless, the bullish breakout has not lasted lengthy as bears have as soon as once more taken management and sellers are actually dominating. Given this current pattern, it’s attainable that the Ethereum value has seen the top of value decline.

Ethereum Decrease Lows Current Troubling Development

Crypto analyst Gianni Pichichero has explained what might be happening with the Ethereum value and why the present pattern might be worrying. This goes by means of the completely different processes and the way the altcoin has been transferring because the begin of the week, ranging from Monday’s bullish rise to the bearish reversal that took the market without warning.

Associated Studying

Gianni defined that the opening vary for the week had established the present month-to-month excessive earlier than breaking low. This showed an entry of large players into the market because the Ethereum value was pushed up quickly to the touch the $2,700 mark for the primary time in over a month. This had set a bullish tone for the week, following into the subsequent day as Tuesday additionally confirmed restoration power,

The subsequent day, Tuesday, the Ethereum price did pump once again and positioned a better excessive than Monday, suggesting {that a} continuation was in play. The day additionally closed out within the inexperienced as ETH bulls remained dominant by means of the buying and selling day.

By Wednesday, there had been a flip out there, whereas the earlier days have been dominated by bullish rallies, consolidation was the order of the day. This introduced the Ethereum value again contained in the opening vary excessive of the week after which marked the primary purple shut of the week.

This primary purple shut, Gianni explains, was a bearish sign. It initially didn’t sign that the Ethereum price would continue to crash. Nonetheless, it did present that the bullishness that started on Monday may lastly be over. Then, by Thursday, it was already a full-blown reversal because the market examined the day before today’s lows. Thursday’s purple shut was simply as bearish because the market turned in expectation of bearish information.

Associated Studying: Is Bitcoin Price Turning Bullish Or Bearish? Crypto Analyst Reveals Critical Levels To Watch

The formation of decrease lows on each days has been worrying, and the analyst outlined within the chart that there might be a attainable breakdown of the value. On this case, the Ethereum price could again crash back below $2,400, wiping out a notable quantity of good points gathered over the previous few weeks.

As this unfolds, Gianni means that there wouldn’t be any crazy moves, however that focus ought to be on in search of alternatives to promote excessive within the present market. “ I will likely be in search of any promote excessive alternative after the information, strengthened with bearish value motion, as triple tops, double tops and any form of reversal patterns into the newest excessive in place,” he stated.

Featured picture from Dall.E, chart from TradingView.com