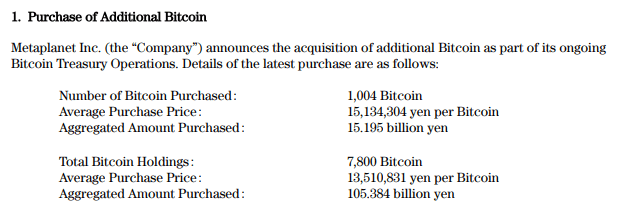

Metaplanet, referred to as Japan’s main Bitcoin treasury firm, has announced the acquisition of 1,004 Bitcoin for about $104.3 million, at a mean value of round $103,873 per BTC. This newest buy brings the corporate’s whole Bitcoin holdings to 7,800 BTC.

Metaplanet began accumulating Bitcoin in April 2024 with about 98 BTC, costing round 1 billion yen. By the top of 2024, that they had elevated their holdings to just about 1,762 BTC with a price foundation of about 20.9 billion yen. After formally launching their Bitcoin Treasury Operations on December 18, 2024, the corporate quickly expanded their Bitcoin holdings, reaching 7,800 BTC by Might 19, 2025. This progress was funded by way of capital market actions and working revenue, rising their whole value foundation to over 105 billion yen.

BTC holdings have exploded, up 3.9x year-to-date with over 5,000 BTC added in 2025 alone. Since switching to a Bitcoin-focused technique, Metaplanet has seen its BTC internet asset worth develop by 103.1x and its market cap by 138.1x.

Over the previous 30 days alone, Metaplanet has added 3,275 BTC, aggressively increasing its Bitcoin treasury amid a 189.1% year-to-date yield on Bitcoin. Metaplanet’s Bitcoin technique has delivered important returns for shareholders, with BTC Yield reaching 47.8% quarter-to-date. Since July 2024, the agency has reported quarterly BTC Yields of 41.7%, 309.8%, 95.6%, and 47.8%, driving sturdy Bitcoin-based efficiency even amid capital market actions and dilution from share issuances.

Metaplanet additionally posted its greatest quarter but. In Q1 FY2025, income hit ¥877 million (up 8% quarter-over-quarter), and working revenue hit a report ¥593 million (up 11%). Whole property jumped 81% to ¥55.0 billion, and internet property surged 197% to ¥50.4 billion.

Despite the fact that Bitcoin’s value dip on the finish of March triggered a ¥7.4 billion valuation loss, the corporate bounced again quick. As of Might 12, it reported ¥13.5 billion in unrealized good points because of the market rebound. Web revenue for the quarter got here in at ¥5.0 billion, and core operations stayed sturdy.

“Guided by this conviction, we pivoted in 2024 to turn into Japan’s first devoted Bitcoin Treasury Firm,” mentioned Metaplanet’s administration in its Q1 earnings presentation. “In Q1 2025, we launched—and have already executed 87% of—a two-year, ¥116 billion “moving-strike” warrant program: the biggest and lowest-cost fairness financing of its form ever positioned in Japan.”