Sovereign funding in Bitcoin is accelerating—simply not all the time in probably the most direct means. In a brand new report, Normal Chartered Financial institution says oblique publicity by way of Technique (previously MicroStrategy) is quietly growing amongst authorities entities, reinforcing the financial institution’s long-standing worth prediction that Bitcoin will attain $500,000 earlier than President Donald Trump leaves workplace in 2029.

“The newest 13F knowledge from the U.S. Securities and Alternate Fee (SEC) helps our core thesis that Bitcoin (BTC) will attain the $500,000 degree earlier than Trump leaves workplace because it attracts a wider vary of institutional consumers,” wrote Geoffrey Kendrick, Normal Chartered’s international head of digital property analysis. “As extra traders acquire entry to the asset and as volatility falls, we imagine portfolios will migrate in the direction of their optimum degree from an underweight beginning place in BTC.”

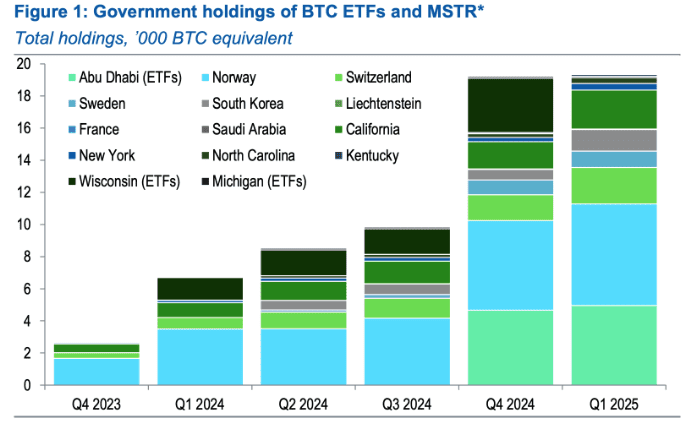

Q1 13F filings revealed a slowdown in direct bitcoin ETF shopping for—Wisconsin’s state fund exited its total 3,400 BTC-equivalent IBIT place—whereas government-linked purchases of MSTR shares have been on the rise. Abu Dhabi’s Mubadala, for example, upped its IBIT publicity to five,000 BTC equal, however Kendrick says the larger story is elsewhere.

“We imagine that in some instances, MSTR holdings by authorities entities replicate a need to realize Bitcoin publicity the place native laws don’t permit direct BTC holdings,” he stated.

France and Saudi Arabia took first-time MSTR positions in Q1. In the meantime, Norway’s Authorities Pension Fund, the Swiss Nationwide Financial institution, and South Korea’s public funds every added publicity equal to 700 BTC. U.S. retirement funds in states like California and New York added a mixed 1,000 BTC equal by way of MSTR. Kendrick known as the development “very encouraging.”

“The quarterly 13F knowledge is the perfect take a look at of our thesis that BTC will appeal to new institutional purchaser varieties because the market matures, serving to the value attain our USD 500,000 degree,” Kendrick stated. “When establishments purchase Bitcoin, costs are inclined to rise.”

This isn’t Kendrick’s first bullish name. Final month, he admitted his prior $120K forecast for Q2 2025 was “too low,” citing surging inflows into U.S. spot BTC ETFs—totaling $5.3 billion over simply three weeks. On the time, Kendrick revised his 2025 year-end goal to $200,000.

Normal Chartered’s newest evaluation reveals that Bitcoin’s function in institutional portfolios is maturing past tech volatility correlation—now more and more seen as a macro hedge. “It’s now all about flows,” Kendrick stated. “And flows are coming in lots of kinds.”