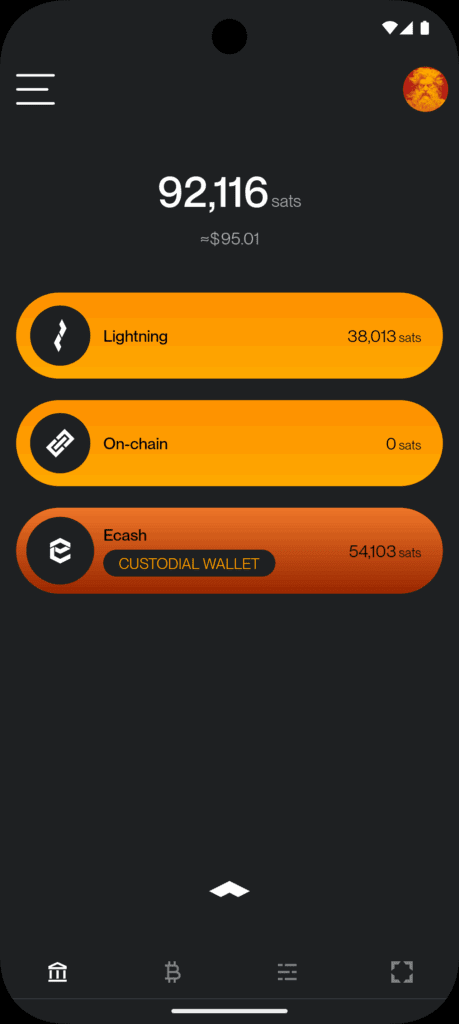

The U.S.-based Bitcoin and Lightning cellular pockets Zeus just lately introduced an alpha-release integration of Cashu. The transfer marks the primary integration of ecash into a well-liked Bitcoin pockets, breaking new floor for potential person adoption to Bitcoin.

Cashu is a sizzling new implementation of Chaumian ecash, a type of digital money invented by David Chaum in the ’90s that has unimaginable privateness and scalability properties, with the trade-off of being basically centralized, requiring a major quantity of belief within the issuer.

In a counterintuitive transfer for Zeus, referred to as the go-to instrument for superior Lightning customers looking for to hook up with their residence nodes, the mixing of Cashu acknowledges a “final mile” problem Lightning wallets face when delivering Bitcoin to the lots.

“We mainly began off because the cypherpunk pockets, proper? You bought to arrange your personal Lightning node and hook up with it with Zeus. The final two years, we put the node within the cellphone with one click on, you may run all of it in a standalone app with out a distant node,” Evan Kaloudis, founder and CEO of Zeus, instructed Bitcoin Journal.

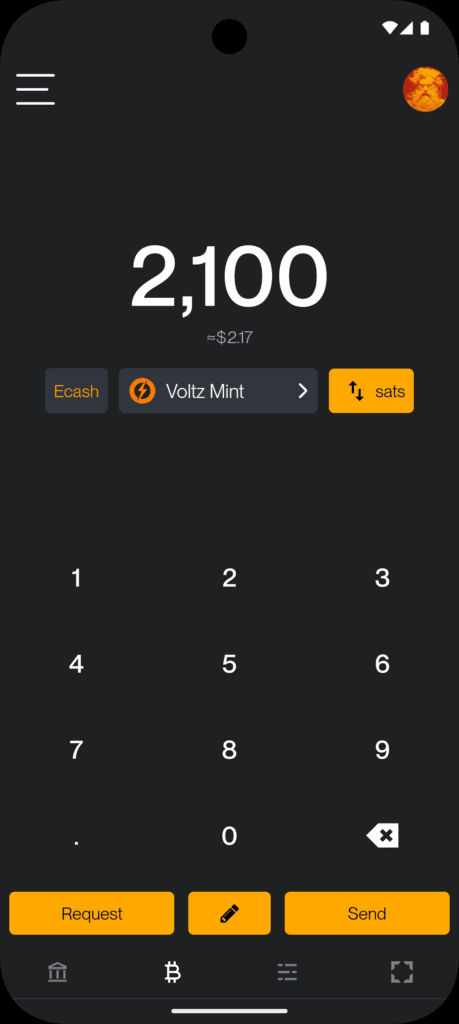

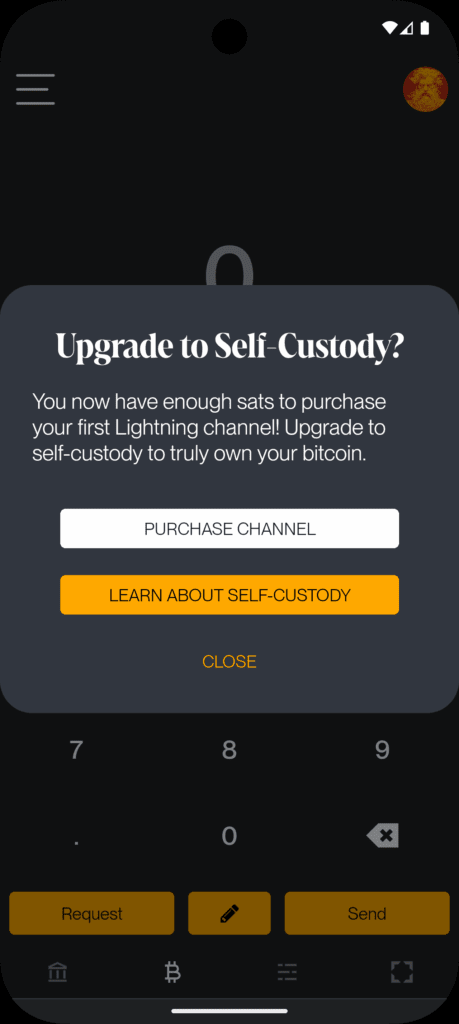

“Cashu addresses uneconomical self-custody for small bitcoin quantities. On-chain, the mud restrict is 546 satoshis, and Layer two programs like Lightning have prices for channel setup or unilateral exits that aren’t extensively mentioned,” Evan defined, highlighting a serious level of friction in noncustodial Lightning wallets: the necessity for liquidity and channel administration. Whereas these esoteric facets of the Lightning Community have been largely abstracted away since its invention in 2016, these elementary trade-offs proceed to manifest even in probably the most subtle and user-friendly wallets.

Within the case of each Phoenix and Zeus Pockets, two of the preferred noncustodial choices out there, customers should pay as much as 10,000 sats upfront to achieve spending capability. These charges are essential to cowl the on-chain charges spent to open a channel for the person towards the pockets’s liquidity service supplier, unlocking a noncustodial expertise.

The required up-front payment is tough to elucidate and represents a painful onboarding expertise for brand new customers who’re used to fiat apps giving them cash to hitch as an alternative. The result’s the proliferation of custodial Lightning wallets like Pockets of Satoshi (WOS), which gained huge adoption early on by leveraging the worldwide, near-instant settlement energy of Bitcoin mixed with the wonderful person expertise centralized wallets can create. Main developments have been revamped seven years after the Lightning Community’s inception, nonetheless, and Zeus Pockets is pushing the boundaries.

“With Ecash, we make it really easy that anybody can arrange a pockets and begin collaborating in our ecosystem, which I actually suppose goes to grow to be an increasing number of prevalent,” Evan defined.

Right now, at roughly $100,000 per bitcoin, 1,000 satoshis are equal to $1, transactions of those sizes are referred to as microtransactions — a well-liked instance are Nostr social media ideas referred to as zaps. However discovering the fitting instrument for this use case shouldn’t be easy. Self custodied wallets like Phoenix cost transaction charges within the lots of of satoshis, even with open channels, and on-chain charges usually value the identical and are slower to settle. In consequence, there’s a complete class of spending that’s solely served by cheaper alternate options equivalent to custodial lightning wallets like WOS or Blink, however end in vital privateness tradeoffs, usually requiring cellphone numbers from customers and in some instances extra superior KYC and IP monitoring. Cashu hopes to serve this market with decrease privateness prices, the identical ease of use, pace and aggressive charges.

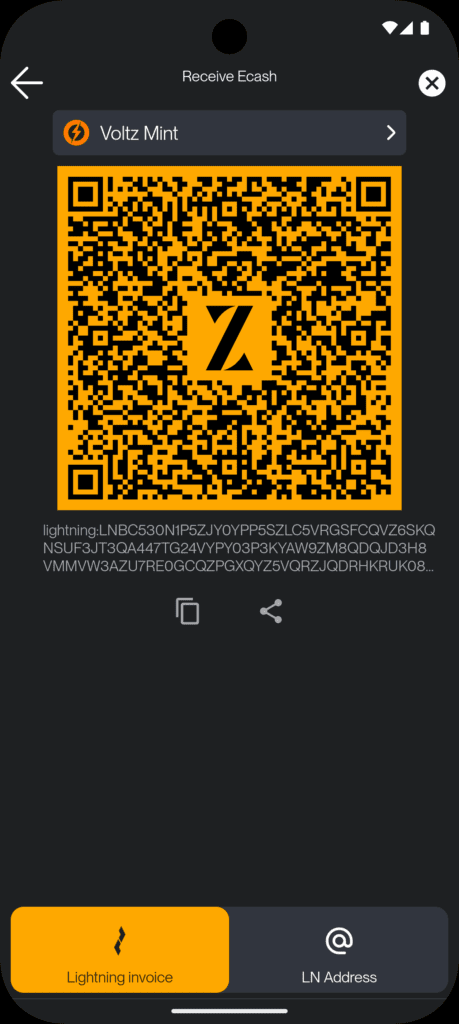

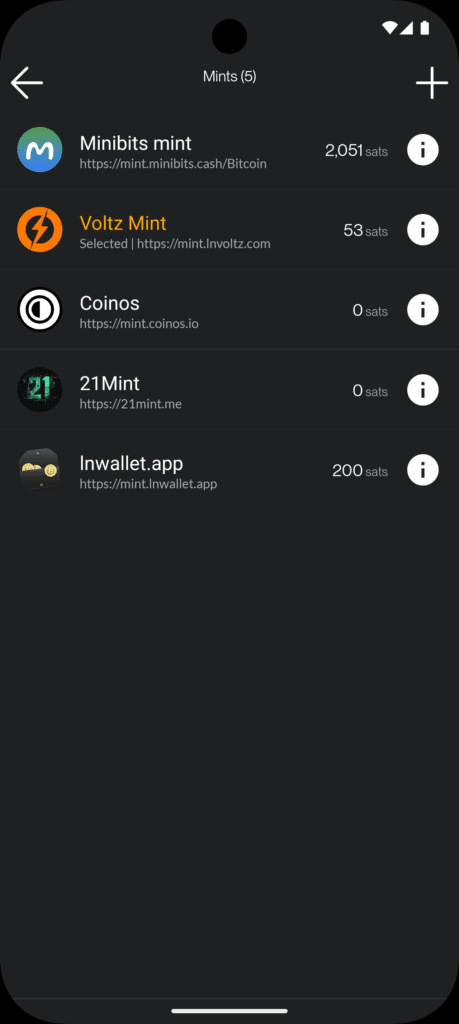

Digging deeper into the Cashu integration, Evan defined that “For customers this implies with the ability to decide and swap between custodians in a single app. For builders this implies with the ability to defer custodial obligations to 3rd events and never need to wire up a brand new integration when your present custodian halts operations.”

Zaps are satoshi-denominated rewards delivered as “likes” or micro-tips for content material within the Nostr social media ecosystem. A zap may be as small as one satoshi, the smallest quantity of bitcoin that may be technically transferred, equal at this time to a couple of tenth of a penny. “However I believe if we take a look at Nostr and also you’re seeing how many individuals are zapping and the way massive part of that ecosystem it’s. It’s like, persons are prepared to do it,” Evan defined.

“Cashu, whereas custodial, lets customers accumulate small quantities — say, through Nostr zaps — without having 6,000 satoshis to open a Lightning channel. ZEUS prompts customers to improve to self-custody as their steadiness grows,” he concluded, explaining that the pockets will successfully annoy customers into self custody, one in every of a number of design selections made to mitigate the dangers launched by Cashu.

The trade-offs launched by Cashu problem the widespread understanding of custody as an either-or in Bitcoin. Traditionally you had been both a centralized — custodial — change, otherwise you had been a noncustodial Bitcoin pockets. Within the former, you entrust the cash to a 3rd get together; within the latter you are taking private duty for these cash and their corresponding personal keys. Cashu modifications this paradigm by introducing bitcoin-denominated ecash notes or “nuts,” that are bearer devices that must be backed by a full bitcoin reserve and Lightning interoperability for fast withdraw.

Just like fiat money, you could take management and duty over these notes, however there’s additionally counterparty threat. Within the case of Cashu, there are particular issues the issuing mint can theoretically do to use their customers — akin to how a financial institution can run on a fractional reserve.

The large distinction between Cashu or custodial Bitcoin exchanges and fiat foreign money is that Cashu is open supply, is designed round person privateness, and scales very properly. It makes the price of working a mint decrease than both different, a function that makes mint competitors simpler, in principle countering the centralizing community results of particular mints.

Lastly, the person expertise of storing Cashu tokens has been connected to recognized types of Bitcoin self custody such because the obtain of 12-words seeds through numerous mechanisms, although implementations nonetheless range from pockets to pockets and the entire ecosystem is in its early levels.

To additional mitigate the custodial threat of Chaumian-style ecash in Bitcoin, the Cashu group has developed numerous strategies for mechanically managing custody threat.

“Customers can break up threat by utilizing a number of mints, switching between them within the person interface. Quickly, ZEUS will information customers to pick 5 or 6 respected mints, mechanically balancing funds to reduce publicity,” Evan defined, referring to a specific method referred to as automated financial institution runs. The thought is that as some Cashu mints might maintain extra of your funds, Zeus de-ranks them and rotates worth out to reduce threat.

“I believe the thought goes to be that we information customers to select 5 or 6 respected mints… And from there, customers will be capable of have the pockets mechanically swap between these mints and decide which mint must be receiving the steadiness relying on the steadiness of all of the mints presently. So that you’ll be like, OK. MiniBits has method an excessive amount of cash. Let’s swap the default to one of many mints that doesn’t have rather a lot. In order that method you may type of mitigate or reasonably distribute the rug threat there,” Evan defined, including, “Our Uncover Mint function pulls opinions from bitcoinmints.com, displaying vouch counts and person suggestions, like mint reliability or longevity,” he defined, describing the repute layer stacked on prime of the assorted different threat administration mechanisms.

There isn’t any recognized method to make use of Chaumian-style ecash in a completely noncustodial method. So so long as the custody threat may be minimized, the scaling and privateness upside turns into exceptional.

One of many alternatives that ecash unlocks is microtransactions, the preferred instance of that are Nostr Zaps usually in single greenback ranges of worth transferred, although it applies to small Lightning transactions as properly. This use case triggers an vital technical query that predates Bitcoin, do microtransactions really make financial sense?

There’s a long-standing argument concerning the person expertise friction inherent in microtransactions. The time period dates again to 1999, when Nick Szabo, one of many mental fathers of Bitcoin, wrote a thesis on “Micropayments and Mental Transaction Costs,” explaining that if a cost is just too small, it turns into arduous to calculate, and the psychological value of calculating it turns into larger than the worth at stake.

In his paper, Szabo really helpful that builders concentrate on minimizing these cognitive prices from a design perspective, because the person interface posed a way more severe problem to the theorized use case of microtransactions than anything. Szabo’s thesis has stood as a key clarification for the failure of microtransactions to achieve adoption. Nonetheless, Bitcoiners have been occupied with the issue for a very long time, and a few consider they may have solved it.

Zeus’s integration of Cashu might mark an vital second in bringing Bitcoin to the mainstream through zaps. Echoing the proliferation of emojis and Fb’s iconic “like” button, entrepreneurs like Evan and Calle, the founding father of Cashu, consider zaps might make bitcoin straightforward to make use of. Zaps current a selected alternative, a brand new method for the general public to accumulate and expertise bitcoin that doesn’t come from exchanges or brokerages as a legacy-wrapped funding product.

Relatively than a $100,000 asset, zaps are internet-tipping expertise. It means sending just a few satoshis to a pal for posting a humorous meme on a Nostr app or producing high-quality content material, realizing you could possibly be rewarded immediately with bitcoin from those that discover it priceless.

Evan believes that with the fitting interface, it’s attainable, and Nick Szabo’s warning about microtransactions might have been addressed.

“If it’s as senseless as one click on, like urgent the guts button — you press the zap button, it doesn’t require you to fireside up your pockets and select the vacation spot. If it’s only a press away, then I believe plenty of that psychological burden Szabo talks about will get pushed apart since you don’t have time to consider it. Nostr’s zap function exhibits persons are prepared to ship small quantities — like 1,000 satoshis for an excellent publish — if the UX is seamless, with a single click on.”

Delivering a Pockets of Satoshi-style person expertise through a completely open-source and trust-minimized software program stack isn’t any straightforward feat; in actual fact, it’s arguably the arduous path.

When WOS first launched, it made waves within the Bitcoin world. No 12-word seed obtain? No account creation web page? Simply obtain and ship sats with instantaneous settlement and barely any transaction charges?

The expertise was so wonderful it’s nonetheless some of the in style Bitcoin wallets. However this was solely attainable on the time because of the centralized, fully custodial and closed supply method taken by the creators of WOS. They outlined the usual and set the bar of person expertise, however now open supply is catching up.

Zeus Pockets has been strolling this effective line between working in public and working a profit-motivated start-up, and to date so good.

“The pockets is totally open-source, verifiable on GitHub, with 50+ exterior contributors. Open-source builds belief, attracts customers to our paid providers, and prevents black-box dangers,” Evan defined about why open supply issues in the case of Bitcoin software program.

Whereas the downsides of open supply are self-evident to many builders — others might copy your code and outcompete you, and the code must be adequate that hackers can’t simply break it — the upsides have now began to snowball.

“Now we have just a few workers proper now which can be hacking on the Zeus code on daily basis, however we’ve obtained 50+ exterior code contributors which have labored on the mission,” Evan defined when requested concerning the upsides of open supply, including that “being open supply additionally permits you to iterate on the pockets and the function set and that pulls extra customers too. And in the meantime, we’re in a position to plug in our paid providers just like the default choices.”

From a enterprise mannequin perspective, they’re following the trade path of turning into liquidity suppliers for the lightning community:

“Income comes from our LSP, the place customers lease channels for 2 weeks to a 12 months, renewable indefinitely. Our White Glove service helps purchasers like PubKey with node administration,” Evan defined.

Nonetheless, Zeus’s biggest problem got here in the course of the spring of 2024 with the arrest and prosecution of the Samourai Pockets builders — a shot throughout the bow that intimidated many Bitcoin entrepreneurs out of the U.S., inducing Zeus’ prime rivals, Phoenix Pockets and WOS. Many firms had already hedged their bets by incorporating offshore. Zeus, based and constructed within the U.S., was not one in every of them; they mentioned they might be going down with the ship.

“It was a scary time, with Pockets of Satoshi and Phoenix pulling out, inflicting panic. I used to be about to have my first child and feared the results, however folding out of worry felt worse. We wished to push again and provides customers confidence that ZEUS wouldn’t abandon them,” Evan recalled. And the braveness it took to remain within the U.S. beneath such hostility paid off. With the highest rivals out of the U.S., Bitcoiners searching for noncustodial software program and good person interfaces had only a few choices.

“It was insane — on the time the LSP was simply getting began, however at the moment, in all probability 250 to 300% progress within the first six months. So we noticed a ton of exercise on the LSP,” Evan recalled, “So wanting again at it, I wouldn’t change a factor… That was peanuts. We’re going to need to make some far more tough selections down the street, doubtlessly. And we have to be ready for when these days occur. So, I believe, in plenty of methods, this was similar to a trial run and we handed.”