Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

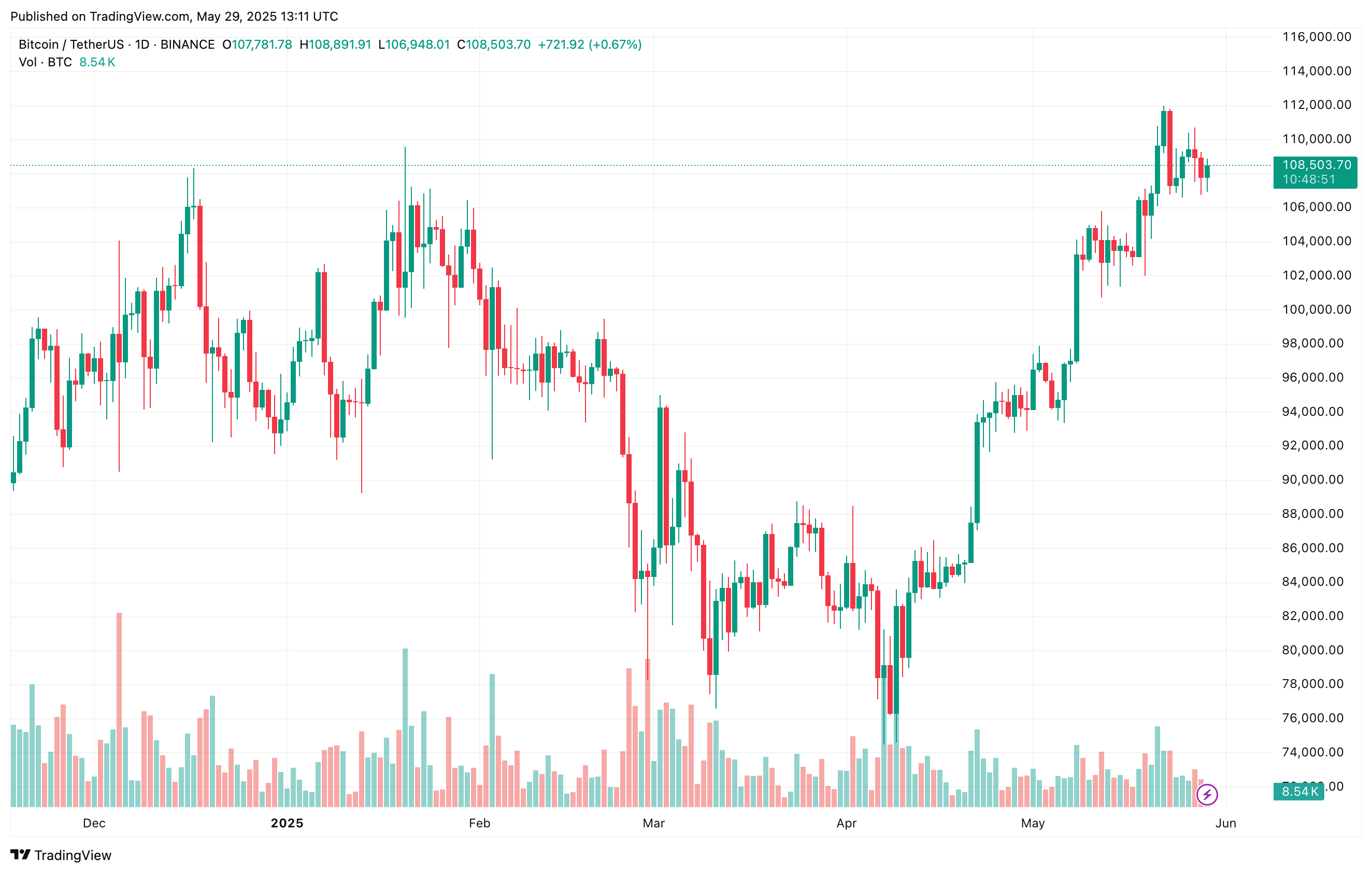

Bitcoin (BTC) continues to commerce near its new all-time excessive (ATH) of $111,980, set earlier this week. Whereas some argue that the highest digital asset could also be operating out of steam, Binance trade move knowledge means that sure investor teams are reluctant to promote their BTC simply but, anticipating additional upside.

Bitcoin Inflows To Binance Recommend Additional Upside Attainable

In response to a latest CryptoQuant Quicktake publish by on-chain analyst Darkfost, analyzing BTC inflows to Binance from each short-term holders (STHs) and long-term holders (LTHs) can supply significant insights into promoting strain and its potential impression on value.

Associated Studying

Darkfost famous that STHs are usually probably the most reactive and emotionally pushed investor group on the subject of market actions. The analyst shared a number of examples from previous market cycles.

As an example, through the value correction in August 2024 when BTC dropped from round $69,000 to $53,000, the STH cohort despatched greater than 12,000 BTC to Binance. Equally, the group offloaded over 14,000 BTC onto Binance through the tariff-induced panic in early March 2025.

Nevertheless, present conduct differs. Amid the continuing rally, promoting strain from STHs stays “very reasonable,” with solely 8,000 BTC despatched to Binance thus far.

LTHs are exhibiting an identical pattern. On the 2024 market peak, LTHs deposited 626 BTC to Binance, and 254 BTC earlier than the earlier high. In distinction, simply 86 BTC have been deposited by LTHs throughout this present rally. The analyst concluded:

Whether or not we’re speaking about STH or LTH, inflows to Binance will not be regarding in the intervening time. Nevertheless, this could nonetheless be thought-about within the context of present demand, which stays comparatively robust for now.

Though the demand for BTC stays wholesome as of now, some warning indicators are beginning to emerge. In an X publish, famous crypto analyst Ali Martinez provided commentary on Bitcoin’s present range-bound value motion, warning that if it drops under the $106,800 help stage, a pointy breakdown could observe.

No Panic Promoting Noticed But

Traditionally, when BTC hits or approaches a brand new ATH, it tends to set off a wave of profit-taking, resulting in substantial promoting strain. Nevertheless, this has not been noticed through the present cycle.

Associated Studying

Current evaluation shows that each STH and LTH cohorts are sitting on elevated unrealized earnings, but there aren’t any robust indicators of promoting. Moreover, trade withdrawals are on the rise, suggesting that buyers could also be anticipating additional value appreciation.

One other bullish indicator is the comparatively low level of retail participation on this rally – usually an indication that the market hasn’t but reached euphoric circumstances. At press time, BTC trades at $10,503, down 0.3% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, X, and TradingView.com