Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is displaying resilience amid the current wave of market volatility and uncertainty. Whereas the broader crypto market has pulled again over the previous few weeks, ETH continues to carry agency above the $2,500 degree — a key psychological and technical help zone. This power has caught the eye of merchants and analysts who see Ethereum’s present worth motion as a possible launchpad for a transfer into increased territory.

Associated Studying

Regardless of the retracement throughout main altcoins, Ethereum stays structurally intact, with bulls defending the decrease boundary of its present vary. The dearth of panic-selling at these ranges suggests rising confidence in ETH’s long-term trajectory, whilst macroeconomic pressures — together with tighter liquidity and geopolitical uncertainty — proceed to weigh on sentiment.

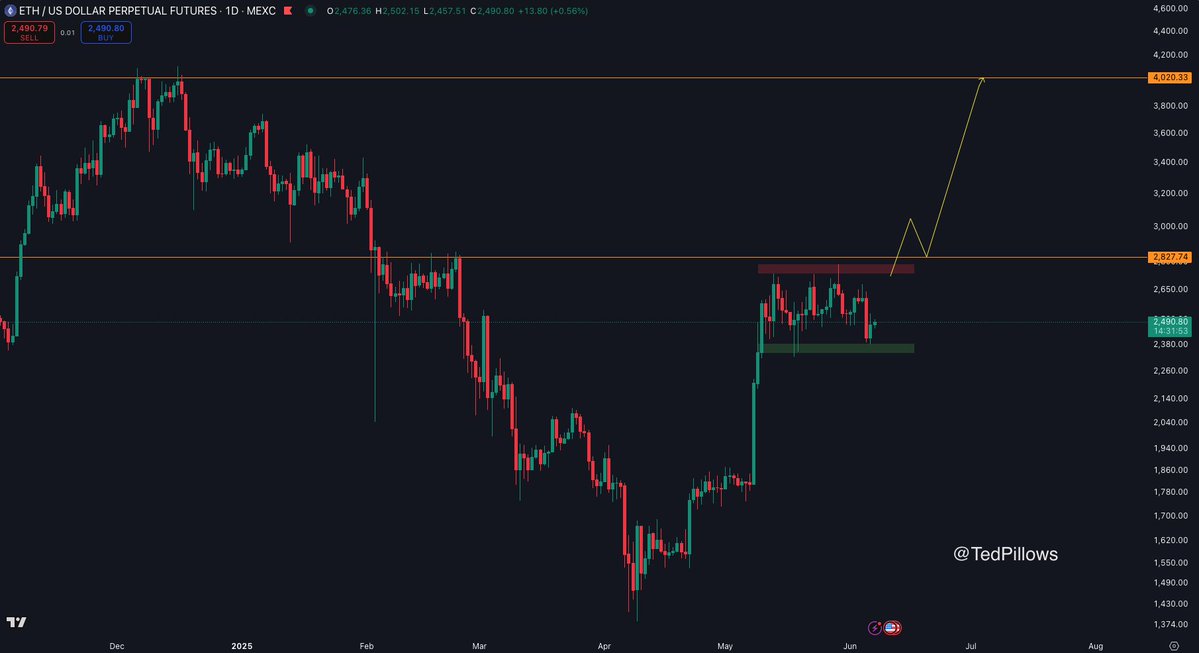

Prime analyst Ted Pillows not too long ago shared a technical replace highlighting that ETH continues to be buying and selling inside a well-defined vary. In line with his view, Ethereum’s skill to consolidate with out dropping important help is an indication of underlying power. A breakout above the vary excessive might set off renewed momentum towards the $2,800–$3,000 area, whereas a breakdown under $2,500 would invalidate the present setup.

Ethereum Approaches Pivotal Zone Amid Uncertainty

The crypto market has been navigating a risky surroundings, and Ethereum is not any exception. Nonetheless, regardless of the turbulence, ETH has managed to take care of its footing above $2,500 — a key help degree that continues to behave as a buffer in opposition to deeper draw back. With Bitcoin holding robust and altcoins getting ready for potential breakout strikes, the approaching weeks may very well be decisive for Ethereum’s subsequent main pattern.

ETH presently trades 48% under its all-time excessive, however worth motion means that bulls are constructing momentum. Ethereum has absorbed current volatility properly, whilst broader market sentiment stays shaken by rising geopolitical tensions, most notably, the rising battle between Elon Musk and US President Donald Trump. Whereas these headlines have added uncertainty, Ethereum’s skill to remain range-bound displays rising confidence amongst buyers.

Pillows notes that Ethereum continues to be buying and selling inside a well-defined vary, and the construction stays intact. In line with his evaluation, reclaiming the $2,800 degree can be a key breakout set off, doubtlessly opening the door for a quick rally to $4,000. Till then, ETH stays in consolidation mode — however with Bitcoin displaying management and the market coming into a pivotal section, Ethereum may very well be on the verge of catching up.

If bulls can preserve management and push by resistance, ETH might lastly get away of its vary and reenter a bullish worth discovery section. But when resistance holds, merchants might even see one other leg of consolidation. Both means, Ethereum is coming into a key window the place market route will possible be outlined, and the way ETH behaves across the $2,800 mark might decide the altcoin outlook for the remainder of the summer season.

Associated Studying

ETH Weekly Chart Reveals Momentum Constructing Close to Resistance

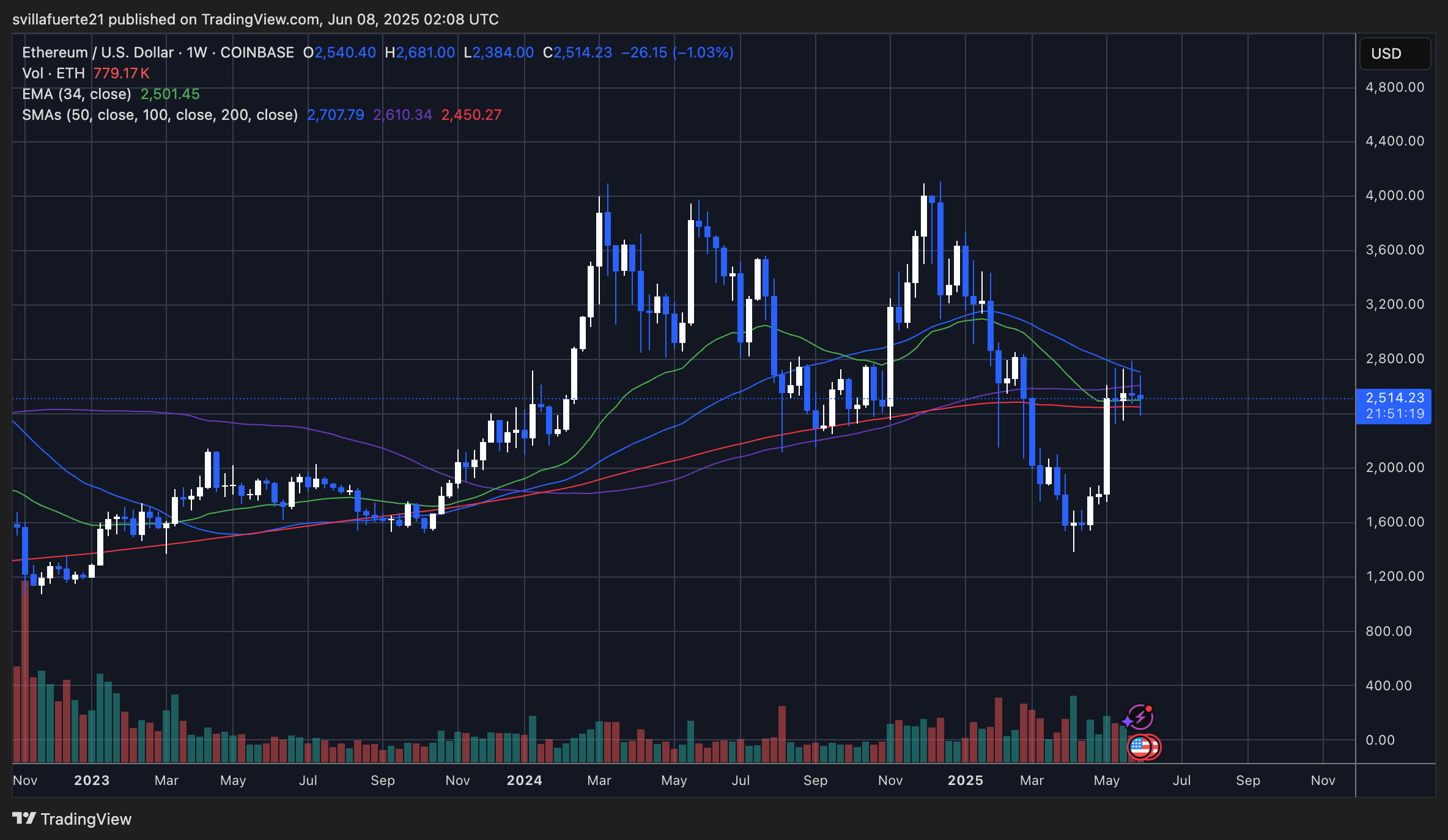

Ethereum is holding regular close to $2,500 as seen on the weekly chart, displaying promising indicators of power regardless of current market-wide volatility. After bouncing sharply from sub-$1,800 ranges in Could, ETH is now consolidating just under the $2,707 resistance — the 50-week easy shifting common (SMA). This degree coincides with the higher boundary of the present vary and stays the important thing line bulls must reclaim to unlock additional upside.

ETH is presently buying and selling above its 34-week EMA ($2,501) and the 200-week SMA ($2,450), each of that are performing as dynamic help. Holding these ranges reinforces the concept consumers are stepping in on dips, offering a powerful base for potential continuation. Nonetheless, the worth continues to be capped by the 100-week SMA at $2,610, making the $2,700–$2,800 area a important resistance zone.

Associated Studying

A weekly shut above this cluster of shifting averages might set off a breakout and pave the way in which towards $3,000 and past. Quantity has remained elevated throughout this consolidation, suggesting sustained curiosity from each merchants and buyers.

Featured picture from Dall-E, chart from TradingView