Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s current worth surge hasn’t stopped warnings of a steep drop. After rising 1.87% in 24 hours and three.61% over the previous week, Bitcoin trades close to $109,192. In line with Peter Brandt, a veteran dealer, these positive aspects may very well be establishing the largest crash in years.

Associated Studying

Crash Situation Outlined

In line with Brandt’s evaluation, Bitcoin might plunge by as a lot as 75%. If that occurs, right now’s $109,800 worth would fall to roughly $27,290. That degree takes us again to the lows of early 2023. It might wipe out an enormous chunk of worth, reversing greater than two years of positive aspects. Few buyers have fashions prepared for such a steep slide.

Historic Parallels With 2022

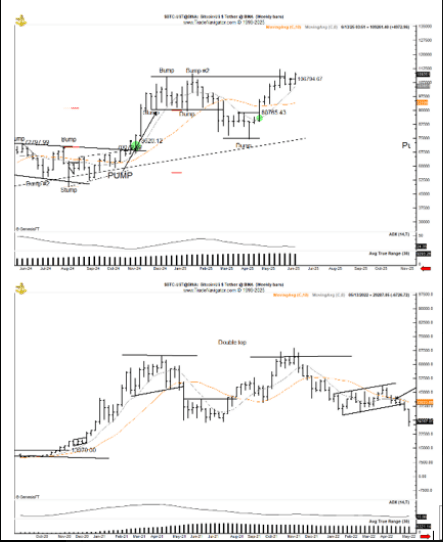

Based mostly on reviews, Brandt sees a replay of the 2022 chart. Again then, Bitcoin hit tops of $65K in April 2021 and $69K in November 2021. It then fell sharply into the bear market, shedding greater than half its worth.

Is Bitcoin $BTC following its 2022 script and establishing for a 75% correction? Doesn’t harm to ask this, does it? pic.twitter.com/BAywkhSwgy

— Peter Brandt (@PeterLBrandt) June 10, 2025

This time round, the world’s prime crypto shaped highs above $108,000 in December 2024 and January 2025, then dropped below $100,000. After recovering close to $112,000 final month, BTC could also be gearing up for the same breakdown.

Set off Factors To Watch

Key technical markers are flashing purple. The 9-period EMA has simply crossed under the 21-period EMA on the every day chart. In previous sell-offs, that crossover marked the beginning of huge downtrends.

Merchants will wish to see if Bitcoin closes under each EMAs for per week or extra. A failure to reclaim the $108,000 degree may very well be the ultimate set off earlier than panic units in.

Market Reactions And Dangers

Derivatives information is blended however leans bearish. Buying and selling quantity jumped virtually 30% to $100 billion, whereas open curiosity rose 1%. On Binance and OKX, the lengthy/quick ratios sit at about 0.5501 and 0.53, exhibiting extra shorts than longs.

When too many individuals guess on a drop, a squeeze can observe—if the crash doesn’t begin quickly. Nonetheless, the present crowding might backfire if Bitcoin holds above assist.

Associated Studying

Funds tied to Bitcoin have seen almost $57 million in outflows over the previous week. That will sound huge, but it surely’s below 0.2% of the roughly $50 billion belongings below administration.

In contrast, Ethereum merchandise attracted $295 million. So whereas some cash is leaving Bitcoin, it’s shifting round inside crypto moderately than fleeing solely.

For now, Bitcoin sits at a crossroads. Will it break assist and roll over towards the mid-$20,000s? Or will it shake off warnings and press greater? Both means, merchants want to observe the $108,000 zone intently.

In line with Brandt, a 75% drop might catch unprepared buyers off guard. Managing danger and holding orders tight appears extra vital now than ever.

Featured picture from Pixabay, chart from TradingView