Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

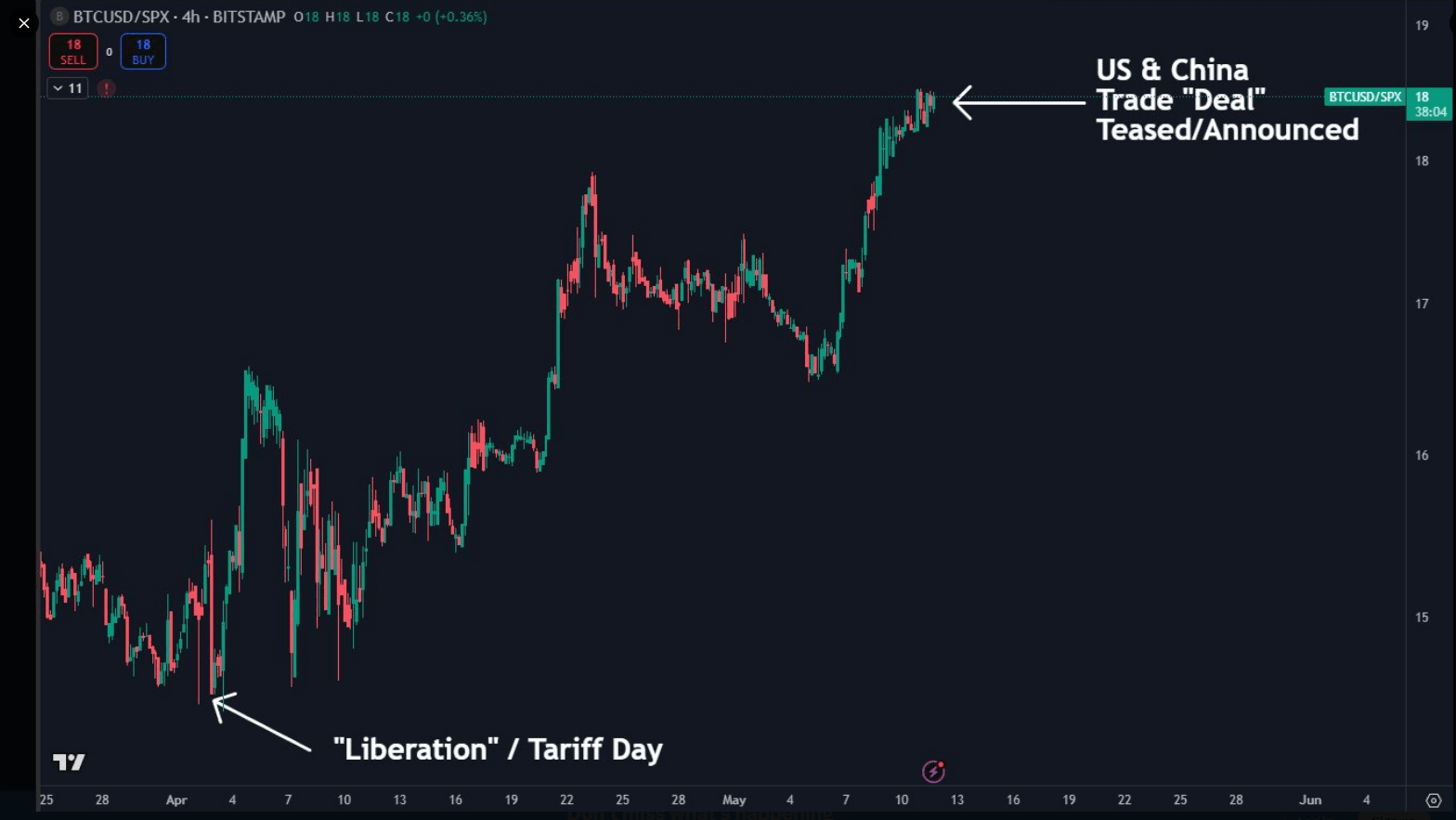

Bitcoin’s worth has surged some 25% since April 2, at the same time as the large inventory indexes declined. The digital foreign money broke by way of $104,000 by Could 12. Conventional markets such because the S&P 500 had been within the crimson concurrently. Primarily based on market information, Bitcoin’s resilience has stood out within the face of sell-offs and tariff negotiations.

Associated Studying

Bitcoin Outpaces Shares

In keeping with studies, the S&P 500 declined virtually 1% throughout April, however Bitcoin rose. Different monetary markets skilled losses throughout the identical weeks. Bitcoin’s enhance was made whereas merchants thought of considerations over escalating tariffs.

The world’s most sought-after crypto asset was seen by some as a way to keep away from charges on international commerce. Nevertheless, there isn’t any proof that any nation utilized crypto to keep away from tariffs.

Settlements By way of Bitcoin

Primarily based on examination by crypto skilled Daan Crypto Trades, there was hypothesis that nations may convey commerce settlements to Bitcoin. The idea gained traction since BTC stood agency even when provide chains and markets had been in bother.

$BTC Has outperformed shares since “Liberation” / Tariff Day on the 2nd of April.

It held up extremely robust throughout a pointy dump on shares in April.

It then additionally proceeded to outperform because the markets bounced and tariffs had been applied.

Again then folks had been questioning… pic.twitter.com/gfvfH80TVP

— Daan Crypto Trades (@DaanCrypto) May 11, 2025

Nonetheless, specialists observe that large on-chain transactions are on the market within the open. Regulators would catch any giant cross-border funds made in crypto. There has not been a reported case of governments turning to Bitcoin in an effort to sidestep duties.

Testing Key Resistance Ranges

In keeping with chart evaluation by Rose Premium Alerts, Bitcoin is at the moment testing an important barrier at $105,000. If BTC breaks down there, it’d retreat into the $100,000 zone. Some sample observers declare an Inverse Head & Shoulders configuration may develop.

💰 $BTC Market Replace#Bitcoin is at the moment testing the Weekly Provide Zone round $105,000 👀

🧠 The almost certainly situation is a rejection from this degree, resulting in the formation of an Inverse Head & Shoulders sample — a setup that would create house for a mini #altseason 📈… pic.twitter.com/aLSPi5qhuq

— Rose Premium Alerts 🌹 (@VipRoseTr) May 11, 2025

That sample requires two distinct shoulders and a decrease trough within the center. At present, the swings have been unbalanced, muddying the picture. A rejection could be adopted by a quick interval of altcoin accumulation earlier than Bitcoin takes off once more the place it left off.

Associated Studying

Lengthy-Time period Outlook Secure

As per market observers, most traders shall be trying to buy dips if Bitcoin breaks resistance. They add that larger costs will put the limelight on pullbacks. Dips offered entry factors throughout earlier rallies. However Bitcoin’s in depth runs persist for a number of months, not days.

Dangers are nonetheless seen by merchants: potential price will increase, laws on crypto, and recent tokens competing for consideration. In the meantime, growing ETF flows and fortified wallets reassure others.

Primarily based on accounts of US–China trade negotiations, any settlement would cut back some rigidity. However there are drivers of Bitcoin’s worth which are impartial of world tariffs. Financial actions, giant traders, and sentiment drive large strikes.

If BTC continues to outrun shares, it’d solidify itself as a substitute in world markets. Within the meantime, merchants are ready for the following course at these vital ranges close to $105,000.

Featured picture from Unsplash, chart from TradingView