Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After reclaiming an important stage over the previous week, Avalanche (AVAX) faces resistance close to the $27 mark. Some analysts have recommended that reclaiming this space may kickstart a rally towards the subsequent key resistance ranges.

Associated Studying

Avalanche Targets $32 Resistance

Avalanche has seen an almost 40% surge over the previous week, jumping from the $19 mark to a three-month excessive of $26.84 on Monday. The cryptocurrency hit an 18-month low of $14.66 throughout the early April retraces however recovered round 37% forward of its latest breakout.

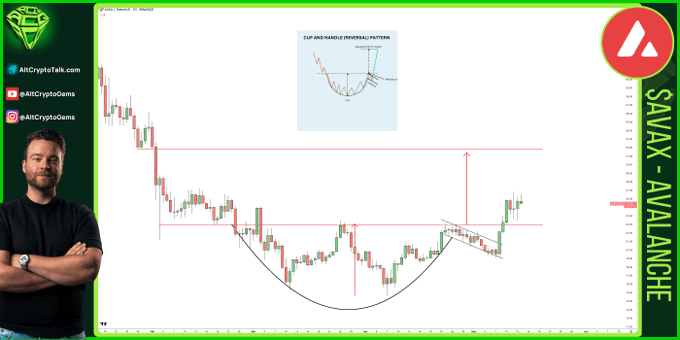

Amid the market restoration, AVAX has damaged out of its five-month downtrend, which noticed the cryptocurrency retrace over 73% from its This autumn 2024 excessive. Furthermore, Avalanche shaped a 2-month Cup-and-Deal with sample, with the neckline on the $23 resistance.

Analyst Sjuul from AltCryptoGems identified that the formation had a “tremendous clear” goal and was “in confluence with the subsequent resistance stage,” at across the $32 mark. This space, misplaced in early February, was an important resistance and help zone earlier than the This autumn 2024 rally and the Q1 2025 market shakeouts.

After the neckline breakout and reclaiming this stage over the weekend, the analyst famous that the goal “is evident now.” As such, Avalanche may doubtless see one other 30% rally towards the $32 mark.

In the meantime, analyst CW highlighted that AVAX has a key promote wall close to the $27 stage, the place it has confronted resistance over the previous few days. Nonetheless, if it breaks by means of this barrier, it may surge to the $36 stage earlier than dealing with the subsequent promoting wall close to the $38.5 space.

One other wall between the $42.5-$46.5 ranges lies forward. Quite the opposite, if the cryptocurrency will get rejected from the primary resistance, the value may revisit the breakout ranges and the downtrend line across the $20 mark, with a promoting wall beneath it that might function help.

AVAX To Repeat BTC And SOL’s Playbook?

Crypto Amsterdam suggested that many altcoins, together with Avalanche, are forming a setup seen in Bitcoin’s (BTC) and Solana’s (SOL) charts. In line with the analyst, the setup follows a Macro vary, divided into 5 cycle phases.

The primary stage, set throughout the bull market, sees a cryptocurrency transfer rapidly towards the highs, setting the vary’s higher boundary. In the course of the second section, firstly of the bear market, the token’s value information “steep decrease lows and highs” towards the vary’s low earlier than shifting to the third stage, the buildup section. On this stage, the cryptocurrency registers a deviation beneath the vary’s low.

The fourth stage sees the cryptocurrency register its first greater excessive and reclaim the vary lows once more. Lastly, the cryptocurrency strikes towards the previous cycle’s excessive throughout the fifth stage, breaking previous the vary’s excessive after reclaiming the mid-zone.

Crypto Amsterdam defined that AVAX’s chart is “one other tremendous clear mini cycle instance.” After hitting its all-time excessive (ATH) of $146 in November 2021, Avalanche set its vary between the $20-$130 ranges, falling beneath the vary’s low in mid-2022.

The cryptocurrency reclaimed the vary low in late 2023, ending the third stage and coming into the fourth one throughout the early 2024 rally. Since then, it has retested the vary lows after its deviation, recovering this stage throughout final week’s breakout.

Associated Studying

If Avalanche continues to observe this setup, it should reclaim the mid-range, at across the $75 mark, to surge to the higher boundary and doubtlessly hit a brand new ATH. Nonetheless, the analyst additionally recommended that falling beneath the native backside would invalidate the setup.

Featured Picture from Unsplash.com, Chart from TradingView.com